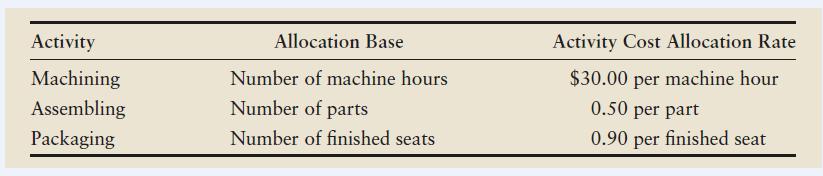

Indianapolis Auto Parts (IAP) has a Seat Manufacturing Department that uses ABC. IAPs activity cost allocation rates

Question:

Indianapolis Auto Parts (IAP) has a Seat Manufacturing Department that uses ABC. IAP’s activity cost allocation rates include the following:

Suppose Ford has asked for a bid on 50,000 built-in baby seats that would be installed as an option on some Ford SUVs. Each seat has 20 parts, and the direct materials cost per seat is \($11\). The job would require 10,000 direct labor hours at a labor wage rate of \($25\) per hour. In addition, IAP will use a total of 400 machine hours to fabricate some of the parts required for the seats.

Requirements:

1. Calculate the total cost of producing and packaging 50,000 baby seats. Also calculate the average cost per seat.

2. For bidding, IAP adds a 30% markup to total cost. What price will the company bid for the Ford order?

3. Suppose that instead of an ABC system, IAP has a traditional product costing system that allocates manufacturing overhead at a plantwide overhead rate of \($65\) per direct labor hour. The baby seat order will require 10,000 direct labor hours. Calculate the total cost of producing the baby seats and the average cost per seat. What price will IAP bid using this system’s total cost?

4. Use your answers to Requirements 2 and 3 to explain how ABC can help IAP make a better decision about the bid price it will offer Ford.

Step by Step Answer: