Jennys Flower Shop wants to expand its operations and is looking for a larger facility. The company

Question:

Jenny’s Flower Shop wants to expand its operations and is looking for a larger facility. The company can add to the current building or sell the building and lease a larger facility nearby. Other relevant known facts follow:

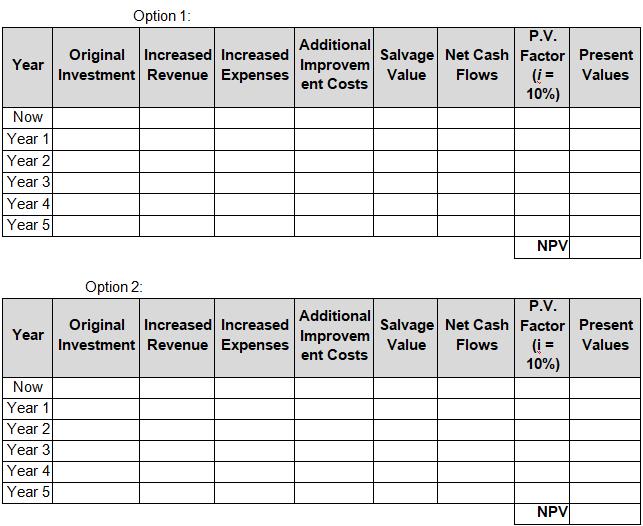

Option 1: It will cost $300,000 to add to the existing capacity but the company will increase revenues by $100,000 per year and will have additional operating expenses due to the increased space (e.g., more electricity, increase in property taxes, insurance) of approximately $25,000 per year. At the end of year 2, the company will incur an additional charge to upgrade the current flower coolers, for a one-time cost of $25,000. The owner is expecting to retire in 5 years and to be able to sell the building for $600,000.

Option 2: Sell the building today as-is for $375,000, and lease a larger facility for $50,000 per year. Anticipated increased revenues will be $80,000 per year and additional operating costs (not including rent) will be $15,000 per year. Jenny will need to renovate the building today to meet the company’s needs, at a one-time cost of $50,000. At the end of the lease term, the residual value of the leasehold improvements will be $5,000. The lease has a 5-year term and cost of capital is 10%.

Using the net present value method, determine which option is better for Jenny using the template.

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope