Journalize the adjusting entry needed on December 31, end of the current year, for each of the

Question:

Journalize the adjusting entry needed on December 31, end of the current year, for each of the following independent cases affecting MidAmerica Water Park.

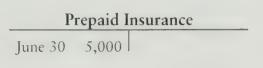

a. Details of Prepaid Insurance are shown in the account:

Mid-America prepays a full year's liability insurance each year on June 30. Record insurance expense for the year ended December 31.

b. Mid-America pays employees each Friday. The amount of the weekly payroll is \(\$ 2,000\) for a five-day workweek. December 31 falls on a Wednesday.

c. Mid-America has borrowed money, signing a note payable. At December 31 Mid-America accrues interest expense of \(\$ 300\) that it will pay next year.

d. The beginning balance of Supplies was \(\$ 1,000\). During the year, MidAmerica purchased supplies for \(\$ 6,100\), and at December 31 the supplies on hand total \(\$ 2,100\).

e. Mid-America is hosting a church group from Chicago. The tour operator paid Mid-America \(\$ 12,000\) as the service fee and MidAmerica recorded this amount as Unearned Service Revenue. By December 31 Mid-America earned \(60 \%\) of the total fee.

f. Depreciation for the current year includes Canoe Equipment, \(\$ 3,800\); and Trucks, \(\$ 1,300\). Make a compound entry.

Step by Step Answer: