Katelynn Corporation manufactures two productskites and gliders. Annual production: Kites: 2,000 units and 2,000 direct labor

Question:

Katelynn Corporation manufactures two products—kites and gliders.

Annual production:

● Kites: 2,000 units and 2,000 direct labor hours

● Gliders: 400 units and 2,000 direct labor hours

● Total estimated overhead: $154,000

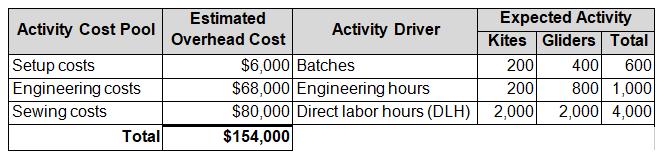

The company is looking at the possibility of changing to an ABC system for its products. If the company used an ABC system, it would have the following three activity cost pools:

The company currently calculates the predetermined overhead rate as follows:

=Total estimated overhead ÷ Total estimated direct labor hours

= $154,000 ÷ 4,000 direct labor hours

= $38.50 overhead per direct labor hour

a. Calculate the total overhead cost per glider using Katelynn Corporation’s existing (traditional) costing system.

b. Calculate the overhead cost per glider under the proposed ABC system.

c. What information do these results provide to management? Be specific.

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope