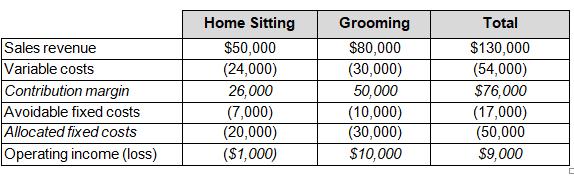

Pet Services offers two product lines: home sitting and grooming. Income statement data for the most recent

Question:

Pet Services offers two product lines: home sitting and grooming. Income statement data for the most recent year is presented below:

a. Assuming fixed costs remain unchanged, how would dropping the home sitting line affect operating income?

b. Discuss whether each of the following costs would likely be included as variable or fixed costs: gasoline, insurance, hourly pay of employees who directly perform the service, supervisor’s salary.

c. You have learned that with $1,500 of additional advertising, the owners estimate that the revenues from the home sitting line could be increased by 10%. None of the other fixed costs are expected to change. What would be the income for home sitting and total income?

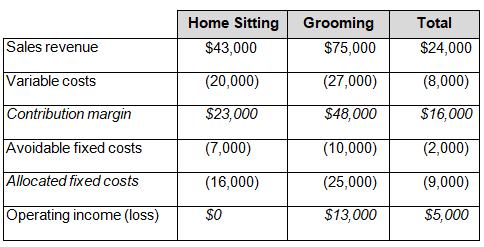

d. The company is considering adding a “walking service” line. Ignore part c. The company hopes to attract new customers in addition to drawing from existing customers. The company is considering adding an introductory offer coupon of 25% off the regular price. Expected results for the upcoming period are:

Evaluate whether the company should add the product line. Discuss what you believe would be the source of information for the estimated expected results. Be specific.

e. The company has identified the following other relevant facts that the owners wish to incorporate into an income statement quantitative analysis: relative amount of time for each product line, including new line; regulations and new permits that might be required for the new line; source of additional part-time employees for the new line; and type of promotion to develop the new line as a major service line. Discuss whether each of those items is relevant and give three other quantitative or qualitative relevant facts.

Step by Step Answer:

Managerial Accounting

ISBN: 9780137689453

1st Edition

Authors: Jennifer Cainas, Celina J. Jozsi, Kelly Richmond Pope