Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from

Question:

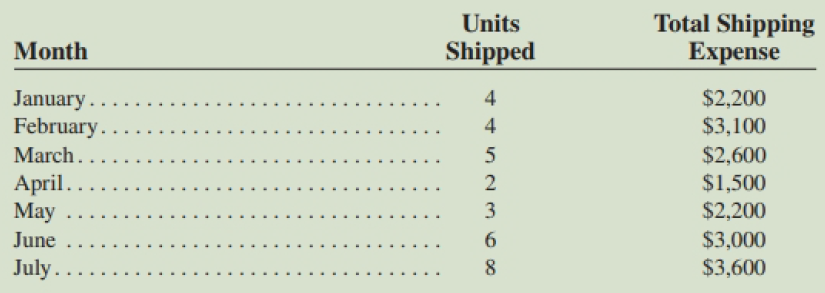

Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable variation in shipping expenses from month to month as per the data below:

If the air conditioners have an average sales price of 5,000, variable manufacturing costs are $2,500 per unit, variable manufacturing overhead is $500 per unit, and variable selling and administration costs (excluding shipping) are $200 per unit, what is the contribution margin per unit?

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby

Question Posted: