Refer to the Wolf Valley Data Set in E12-35A. Requirements: 1. What is the projects NPV? Is

Question:

Refer to the Wolf Valley Data Set in E12-35A.

Requirements:

1. What is the project’s NPV? Is the investment attractive? Why or why not?

2. Assume that the expansion has no residual value. What is the project’s NPV? Is the investment still attractive? Why or why not?

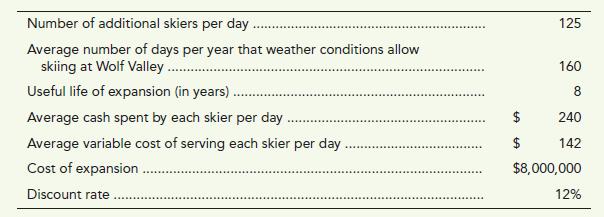

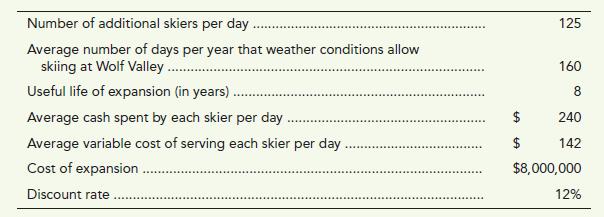

Data From Wolf Valley expansion Data Set:-

Assume that Wolf Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of \($1,000,000\) at the end of its eight-year life.

Data From E12-35A:-

Consider how Wolf Valley, a popular ski resort, could use capital budgeting to decide whether the \($8\) million Brook Park Lodge expansion would be a good investment.

Data From Wolf Valley expansion Data Set:-

Assume that Wolf Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of \($1,000,000\) at the end of its eight-year life.

Step by Step Answer: