The Canyons Resort, a Utah ski resort, recently announced a $400 million expansion to lodging properties, lifts,

Question:

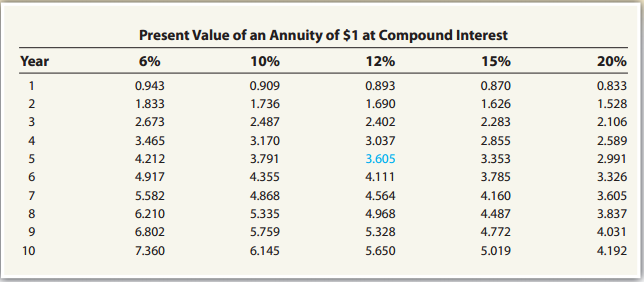

a. Determine the expected internal rate of return of this project for 10 years, using the present value of an annuity of $1 table found in Exhibit 2.

b. What are some uncertainties that could reduce the internal rate of return of this project?

Exhibit 2:

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac

Question Posted: