The management of Broncial Industries Inc. is considering a capital investment project. The net cash flows expected

Question:

The management of Broncial Industries Inc. is considering a capital investment project. The net cash flows expected from the project are $50,000 a year for seven years. The project requires an investment of $243,400, and no residual value is expected.

Determine:

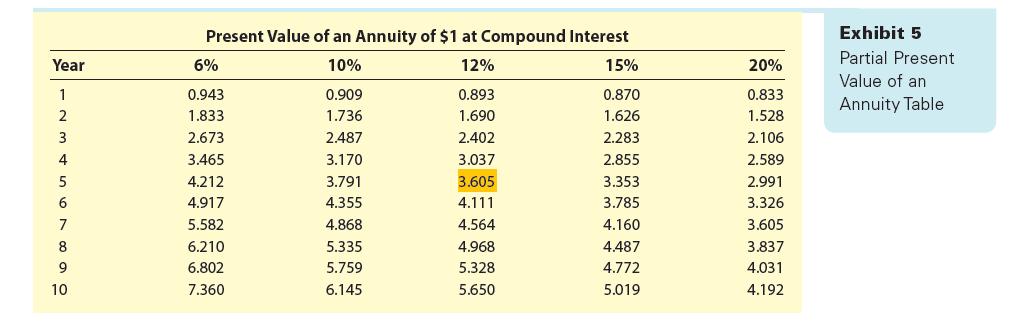

a. The net present value for the project, using a minimum rate of return of 6% and the present value of an annuity table appearing in this chapter (Exhibit 5).

b. The present value index. Round to two decimal places.

c. The internal rate of return for the project by (1) computing a present value factor for an annuity of

$1 and (2) using the present value of an annuity table appearing in this chapter (Exhibit 5).

Step by Step Answer:

Financial And Managerial Accounting

ISBN: 9781337902663

15th Edition

Authors: Carl S. Warren, Jefferson P. Jones, William B. Tayler