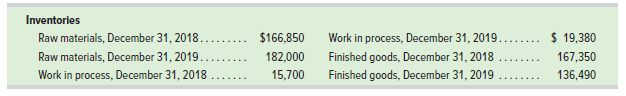

Using the data from Problem 1-2A and the following additional inventory information for Leone Company, complete the

Question:

Using the data from Problem 1-2A and the following additional inventory information for Leone Company, complete the requirements below. Assume income tax expense is $233,725 for the year.

Required

1. Prepare the company?s 2019 schedule of cost of goods manufactured.

2. Prepare the company?s 2019 income statement that reports separate categories for (a) selling expenses and (b) general and administrative expenses.

3. Compute the (a) inventory turnover, defined as cost of goods sold divided by average inventory, and (b) days? sales in inventory, defined as 365 times ending inventory divided by cost of goods sold, for both its raw materials inventory and its finished goods inventory. (To compute turnover and days? sales in inventory for raw materials, use raw materials used rather than cost of goods sold.) Round answers to one decimal place.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Managerial Accounting

ISBN: 978-1260482935

7th edition

Authors: John J Wild, Ken W. Shaw, Barbara Chiappetta