Managers at Firm A and Firm B must make pricing decisions simultaneously. The following demand and long-run

Question:

Managers at Firm A and Firm B must make pricing decisions simultaneously. The following demand and long-run cost conditions are common knowledge to the managers

QA = 72 ? 4PA + 4PB? ? ? ? ? ? ?and ? ? ? ? ? ? LACA = LMCA = 2QB = 100 ? 3PB + 4PB? ? ? ? ? ?and ? ? ? ? ? ? LACB = LMCB = 6.67

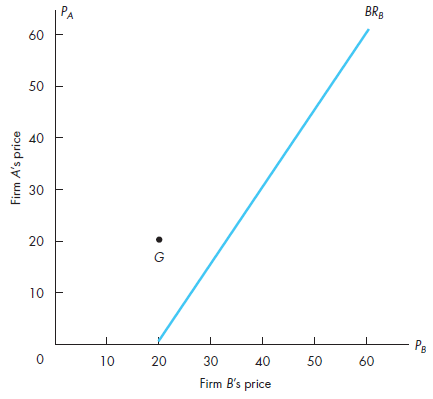

The accompanying figure shows Firm B?s best-response curve, BRB. Only one point on Firm A?s best-response curve, point G, is shown in the figure.

a. Find a second point on Firm A?s best-response curve by finding the best response when Firm A believes Firm B will set a price of $60. Plot this price pair on the graph, label it H, draw the best-response curve for Firm A, and label it BRA.b. What prices do you expect the managers of Firm A and B to set? Why? Label this point on the graph N.c. Compute each firm?s profit at point N.d. Explain carefully why the pair of prices at point H in the figure is not likely to be chosen by the managers.e. Suppose that the managers of the two firms decide to cooperate with each other by both agreeing to set prices PA = $45 and PB = $60. Label this point C in the figure. Compute each firm?s profit at point C. Which firm(s) make(s) more profit at point C than at point N? Why didn?t you give point C as your answer to part b?

Step by Step Answer:

Managerial Economics Foundations of Business Analysis and Strategy

ISBN: 978-0078021909

12th edition

Authors: Christopher Thomas, S. Charles Maurice