A forward start option is an option that comes into existence at some future time T 1

Question:

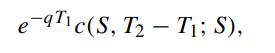

A forward start option is an option that comes into existence at some future time T1 and expires at T2 (T2 > T1). The strike price is set equal the asset price at T1 such that the option is at-the-money at the future option’s initiation time T1. Consider a forward start call option whose underlying asset has value S at current time t and constant dividend yield q, show that the value of the forward start call is given by

where c(S,T2 − T1; S) is the value of an at-the-money call (strike price same as asset price) with time to expiry T2 − T1.

The value of an at-the-money call option is proportional to the asset price.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: