Assume that the T-maturity discounted bond price process B(t,T) follows the one-factor Gaussian HJM under the risk

Question:

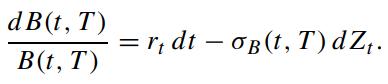

Assume that the T-maturity discounted bond price process B(t,T) follows the one-factor Gaussian HJM under the risk neutral measure Q:

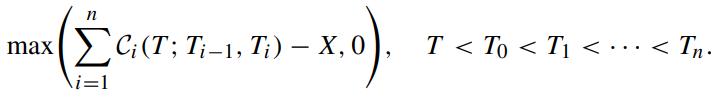

A caption is a call option on a cap, whose terminal payoff at time T is given by

A caption is a call option on a cap, whose terminal payoff at time T is given by

Here, Ci(T ; Ti−1,Ti) is the time-T value of a caplet with payment on the LIBOR Li−1 at time Ti and X is the strike price, i = 1, 2, ··· ,n. Since a cap can be visualized as a series of put options on the zero-coupon bonds, a caption is seen as a compound call on a put. By applying Jamshidian’s decomposition technique (Jamshidian, 1989) for an option on a coupon-bearing bond, find the time-t value of the caption, t < T.

Transcribed Image Text:

dB (t, T) B(t, T) =r, dt - oB(t, T) dZ₁.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To find the timet value of the caption using Jamshidians decomposition technique lets consider the s...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

We would like to price the floor on the composition defined in Problem 8.22 using the LIBOR Market model. Now, we assume that the LIBOR Li(t) follows the arithmetic Brownian process: Problem 8.22...

-

The holder of a European in-the-money call option may suffer loss in profits if the asset price drops substantially just before expiration. The limited period fixed strike lookback feature may help...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Listed below are the genders of the younger winner in the categories of Best Actor and Best Actress for recent and consecutive years. Do the genders of the younger winners appear to occur randomly? F...

-

Wilson Company sells 130 units daily. Each time Wilson orders more units, the supplier takes four days to deliver the inventory. What is Wilsons reorder point (in number of units)?

-

1. Given strong profit growth, has there been any damage to Baidu.coms reputation? 2. What would future reputational damage affect, and how could it be measured? 3. What steps could Baidu.com take to...

-

Reconsider the data from Problem 56. What is the capital recovery cost of Model 334A? Data from problem 56 Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each...

-

Answer the following multiple-choice questions: a. Which of the following could lead to cash flow problems? 1. Tightening of credit by suppliers 2. Easing of credit by suppliers 3. Reduction of...

-

How would a data analyst evaluate a conference call to get a feel for the sentiment of management?

-

Consider a European call option with strike price X maturing at T on a futures whose underlying asset is a T-maturity discount bond. Derive the value of this option under the Gaussian HJM term...

-

Consider a swap with reset dates T 0 ,T 1 , ,T n1 and payment dates T 1 ,T 2 , ,T n . A trigger swap is a contract where the holder has to enter into a swap with fixed swap rate K over the...

-

Assume the same facts as in P4.7, except that P Co elects to measure non-controlling interests as a proportion of identifiable net assets. Required: 1. Prepare the consolidation adjusting entries for...

-

Developing a Maintenance Programme and Maintenance Plan for a fleet of 3 3 ATR 7 2 6 0 0 7 2 - 6 0 0 aircraft Assumptions: All aircraft are new Aircraft utilisation: 1 8 0 0 1 8 0 0 FH / / year ( (...

-

Consider the first step in the database life cycle, the database initial study. How would you do a database initial study for a business intelligence database at Netflix today? What is the company s...

-

What Is Mechanical Engineering? Which pipes are used for steam lines?

-

Assume that you are employed as an international consultant to undertake a private sector assessment of the Pacific Island Country. Select a Pacific Island country for the private sector assessment...

-

6. Consider the following projections (in $ millions) for MBI Corp.: Year 0 Sales Cost of Goods Sold Depreciation EBIT Taxes 380 Year 1 44 360 264 40 56 20 Gross Fixed Assets (Levels) Net Working...

-

Your company paid employees who were eligible for work opportunity credit $25,000 last year. Of these wages, $21,000 is eligible for a tax credit of 40% of the wages. The remaining wages are eligible...

-

A spacecraft has left the earth and is moving toward Mars. An observer on the earth finds that, relative to measurements made when the spacecraft was at rest, its a. length is shorter b. KE is less...

-

Define conflict.

-

Explain contemporary perspectives of conflict.

-

Contrast task, relationship, and process conflict.

-

2 . Call Options Payoff and Profit ( 2 0 points ) A European Call option is selling for $ 3 with an exercise price of $ 5 0 , the underlying at expiration is $ 5 3 . Determine the following option...

-

Jane is a first-grade student who appears to be experiencing both expressive and receptive language difficulties. She has attended her home school since kindergarten and both Jane and her parents are...

-

Project S costs $ 2 8 0 0 0 0 and is expected to produce annual cash flows of $ 3 9 2 0 0 for five year plus an additional one time cash flows of $ 2 8 0 0 0 0 at the end of year five. The RR is 6 %...

Study smarter with the SolutionInn App