Consider a down-and-in American call C di (S, ; X,B), where the down-and-in trigger clause entitles

Question:

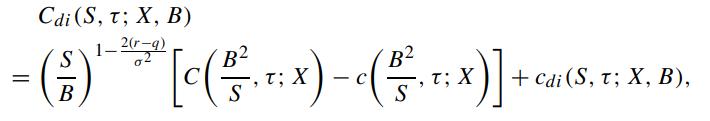

Consider a down-and-in American call Cdi (S, τ ; X,B), where the down-and-in trigger clause entitles the holder to receive an American call option with strike price X when the asset price S falls below the threshold level B. The underlying asset pays dividend yield q and let r denote the riskless interest rate. Let C(S,τ ; X) and c(S,τ ; X) denote the price function of the American call and European call with strike price X, respectively. Show that when B ≤ max (X, r/q X), we have

where cdi (S, τ ; X,B) is the price function of the European down-and-in call counterpart. Find the corresponding form of the price function Cdi (S, τ ; X,B) when (i) B ≥ S∗(∞) and (ii) S∗(0+) ∗(∞), where S∗(τ) is the optimal exercise boundary of the American non-barrier call C(S,τ ; X) (Dai and Kwok, 2004).

where cdi (S, τ ; X,B) is the price function of the European down-and-in call counterpart. Find the corresponding form of the price function Cdi (S, τ ; X,B) when (i) B ≥ S∗(∞) and (ii) S∗(0+) ∗(∞), where S∗(τ) is the optimal exercise boundary of the American non-barrier call C(S,τ ; X) (Dai and Kwok, 2004).

Step by Step Answer: