Consider a European call bond option maturity on T 0 whose underlying bond pays A i

Question:

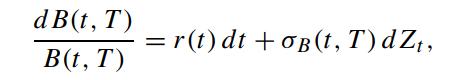

Consider a European call bond option maturity on T0 whose underlying bond pays Ai ≥ 0 at time Ti, 1 ≤ i ≤ n, where 0 0 1 n. Assume that the zero-coupon bond price B(t,T ) follows the one-factor HJM model, where

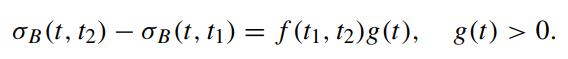

and the deterministic volatility function satisfies

and the deterministic volatility function satisfies

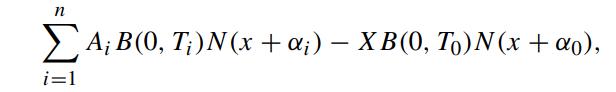

Show that the time-0 price of the European call option on the coupon bearing bond with strike price X is given by (Henrard, 2003)

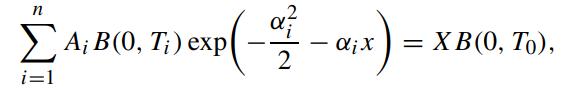

where x is the (unique) solution of

where x is the (unique) solution of

and αi > 0,i = 0, 1, ··· ,n, is given by

![T 2 a = 6 0 [OB (U, T) - OB(U, T)] du.](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/7/010655da952bc9981700637010304.jpg) Here, T is the expiration date of the underlying bond.

Here, T is the expiration date of the underlying bond.

Transcribed Image Text:

dB(t, T) B(t, T) = =r(t) dt + OB(t, T) dZt,

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To derive the expression for the timeO price of the European call option on the couponbearing bond we will follow the steps provided in the problem Given the onefactor HJM model for zerocoupon bond prices dBtT BtT rtdttTdZ And the deterministic volatility function tt tt fttgt Lets consider the European call option on the couponbearing bond with strike price X The payoff of this option at maturity T is given by CTo A maxB0 T X 0 Now lets find the expression for the option price at time t 0 According to the problem the price is given by C0 A B0 TNx 2ax XNr dr Here is the unique solution of CAB0T expax XB0 T And a is given by aUT BUTo dU This expression provides the time0 price of the European call option on the coupon ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

3. The sketch shows an exploded drawing of a pump driven by a 1.5-kW, 1800-rpm motor integrally attached to a 4:1 ratio gear reducer. Reducer shaft C is connected directly to pump shaft C' through a...

-

There are three assets, A, B and C, where A is the market portfolio and C is the risk-free asset. The return on the market has a mean of 12% and a standard deviation of 20%. The risk-free asset...

-

Currently a share of Globex Industries trades for $65 per share. In one year, Globexs share price will be $80 with probability 0.62 or $55 with probability 0.38. A riskless bond also exists with a...

-

Migration is a popular strategy among many species. Monarch butterflies migrate between the Sierra Madre mountains in Mexico and many locations across the USA and Canada. Answer the following...

-

Discuss the following statement: Major opportunities and threats usually result from an interaction among key environmental trends rather than from a single external event or factor.

-

All of the transportation examples appear to apply to long distances. Is it possible for the transportation model to apply on a much smaller scale, for example, within the departments of a store or...

-

Although the customer loyalty project at Petrie Electronics had gone slowly at first, the past few weeks had been fast-paced and busy, Jim Watanabe, the project manager, thought to himself. He had...

-

Aracel Engineering completed the following transactions in the month of June. a. Jenna Aracel, the owner, invested $100,000 cash, office equipment with a value of $5,000, and $60,000 of drafting...

-

16. A general partnership operates a small resort area in Florida. Jeb is given the opportunity to receive a capital interest of $500 in the partnership in exchange for managing the resort from...

-

We would like to price the floor on the composition defined in Problem 8.22 using the LIBOR Market model. Now, we assume that the LIBOR Li(t) follows the arithmetic Brownian process: Problem 8.22...

-

Suppose the dynamics of L i (t) under the forward measure Q T k is governed by (8.3.23), show that the distribution of the LIBOR L i (T ) under Q Tk admits the following lognormal approximation...

-

Quigley Inc. is considering two financial plans for the coming year. Management expects sales to be $301,770, operating costs to be $266,545, assets to be $200,000, and its tax rate to be 35%. Under...

-

Incorrect 0.00 points out of 1.00 Based on this data from the adjusted trial balance for Vases R Us , what will be the Net Income reported on the Income Statement ?

-

5. Given a directed, connected and weighted graph which represents an AOE network. (a) What is the critical path in this network? (3%) (b) Compute the earliest time and the latest time of each...

-

What is price image? O The clarify of a store's pricing structure O The physical visibility of pricing in the store environment O The degree of "hidden" add-ons to prices O The overall perception...

-

A racing car on a straight track sounds a 510 Hz horn during a promotion. The car is moving at 42 m/s and the temperature is 28C. Find the apparent frequency of the horn for a stationary observer...

-

If your pipe is tilted or at an angle, why does gravity not affect fluid velocity as flow continues down the pipe? How is pressure drop not affected if the flow is downward at an angle compared to...

-

How many kilocalories of heat are needed to change 143 N of ethyl alcohol at 65.0C to vapor?

-

What are the 5 Cs of marketing channel structure?

-

Sante Fe Corporation's sales office and manufacturing plant are located in State A. Sante Fe also maintains a manufacturing plant and sales office in State B. For purposes of apportionment, State A...

-

For each of the following items considered independently, indicate whether the circumstances call for an addition modification (A), a subtraction modification (S), or no modification (N) in computing...

-

Perk Corporation is subject to tax only in State A. Perk generated the following income and deductions. Federal taxable income .............. $300,000 State A income tax expense ............. 15,000...

-

3) A 2.0 Kg object rolled down an incline 20 m high at a speed of 5.0 m/s, then rolls up a frictional ramp inclined at 30 where the kinetic friction coefficient for the inclined surface and the...

-

In a competitive labor market, the demand for and supply of labor determines the equilibrium wage rate and the equilibrium level of employment. Discuss the relationship between how these markets...

-

OA snowboarder with a mass of 57 kg starts from rest at the top of a frictionless slope at a height of 45 m. She follows the frictionless path to reach a lowest point, then upwards to another peak....

Study smarter with the SolutionInn App