Consider a forward contract on an underlying commodity, find the portfolio consisting of the underlying commodity and

Question:

Consider a forward contract on an underlying commodity, find the portfolio consisting of the underlying commodity and a bond (bond’s maturity coincides with forward’s maturity) that replicates the forward contract.

(a) Show that the hedge ratio Δ is always equal to one. Give the financial argument to justify Δ = 1.

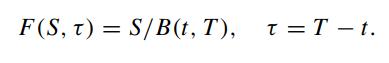

(b) Let B(t,T) denote the time-t price of the unit-par zero-coupon bond maturing at time T and let S denote the price of the commodity at time t. Show that the forward price F(S,τ) is given by

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: