Consider a forward contract whose underlying asset has a holding cost of c j paid at time

Question:

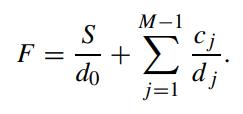

Consider a forward contract whose underlying asset has a holding cost of cj paid at time tj, j = 1, 2, ···, M − 1, where time tM is taken to be the maturity date of the forward. For notational simplicity, we take the initiation date of the swap contract to be time t0. Assume that the asset can be sold short. Let S denote the spot price of the asset at the initiation date, and we use dj to denote the discount factor at time tj for cash received on the expiration date. Show that the forward price F of this forward contract is given by

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: