Consider the pair of American call and put options with the same time to expiry and

Question:

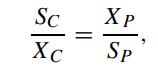

Consider the pair of American call and put options with the same time to expiry τ and on the same underlying asset. Assume the volatility of the asset price to be at most time dependent. Let SC and SP be the spot asset price corresponding to the call and put, respectively (SC and SP need not be the same since the calendar times at which we are comparing values need not be the same). Suppose the two options have the same moneyness, that is,

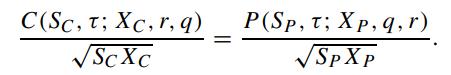

where XC and XP are the strike price corresponding to the call and put, respectively. Let C(SC,τ ; XC,r,q) and P(SP ,τ ; XP ,r,q) denote the price function of the American call and put, respectively. Derive the generalized put-call symmetry relation (Carr and Chesney, 1996)

where XC and XP are the strike price corresponding to the call and put, respectively. Let C(SC,τ ; XC,r,q) and P(SP ,τ ; XP ,r,q) denote the price function of the American call and put, respectively. Derive the generalized put-call symmetry relation (Carr and Chesney, 1996)

Furthermore, let S∗C (τ ; XC,r,q) and S∗P (τ ; XP ,r,q) denote the optimal exercise price of the American call and put, respectively. Show that

![]()

This relation is a generalization of the result given in (5.1.16). ![]()

Step by Step Answer: