Consider the value of a European call option written by an issuer whose only asset is

Question:

Consider the value of a European call option written by an issuer whose only asset is α (

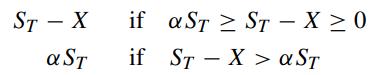

and zero otherwise. Show that the value of this European call option is given by (Johnson and Stulz, 1987)

and zero otherwise. Show that the value of this European call option is given by (Johnson and Stulz, 1987)

Transcribed Image Text:

ST - X a ST aST STX ≥ 0 if if STX a ST

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (4 reviews)

The structure youre describing for the European call option involves ...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider a stock of XYZ Firm . It has an expected return of 10% per year, and it has a estimated return volatility of 20% per year. The risk-free rate is 6% per year (CCR). XYZ stock has a current...

-

You have been asked to estimate the beta of a high-technology firm which has three divisions with the following characteristics. Division Personal Computers Software Computer Mainframes Beta Market...

-

There are three assets, A, B and C, where A is the market portfolio and C is the risk-free asset. The return on the market has a mean of 12% and a standard deviation of 20%. The risk-free asset...

-

Suppose that you are holding your toy submarine under the water. You release it and it begins to ascend. The graph models the depth of the submarine as a function of time. What is the domain and...

-

Presented below are account balances for Monterey Hospital. In addition, cash transactions for the year ended December 31, 2012, are summarized in the T-account. Required: Using the information above...

-

Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year 2014, the inventory records reflected the following: Inventory is valued at cost using the LIFO...

-

The wreck of the S.S. Central America waited 130 years at the bottom of the ocean for someone to come along and claim its trove of gold. Thomas G. Thompson, funded by a multitude of investors, was...

-

Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass...

-

W (K$) 14 13 Rich 12 11 10 9 8 7 6 5 Poor W (K$) 14 13 12 11 10 9 8 7 6 5 4 16 18 20 22 24 26 28 17 19 21 L 20 22 24 26 23 25 27 (M) 21 23 25 27 29 31 28 30 32 34 36 L 33 35 37 (M) 1. There are two...

-

Deduce the corresponding put-call parity relation when the parameters in the European option models are time dependent, namely, volatility of the asset price is (t), dividend yield is q(t) and...

-

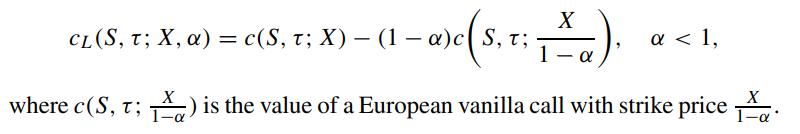

Consider a European capped call option whose terminal payoff function is given by where X is the strike price and M is the cap. Show that the value of the European capped call is given by where c(S,...

-

The reforming of CH4 with CO2 to produce CO and H2 has been examined over a number of dispersed metal catalysts [67, 68]. At 723K, a CO2 partial pressure of 200 Torr, PCH4 = 200 Torr, and a total...

-

Why are H&S systems essential for air travel to most U.S. cities that now have airline service?

-

A meteorologist was simulating the number of days that rain would occur in a month. The random number interval from 01 to 30 was used to indicate that rain occurred on a particular day, and the...

-

Define ASM, RASM, CASM, LF, and yield. How might a change in one affect another?

-

Which of the following is a disadvantage of simulation? a. It is inexpensive even for the most complex problem. b. It always generates the optimal solution to a problem. c. The results are usually...

-

A measure of central tendency is a. expected value. b. variance. c. standard deviation. d. all of the above.

-

GianAuto Corporation manufactures parts and components for manufacturers and suppliers of parts for automobiles, vans, and trucks. Sales have increased each year based in part on the company's...

-

Using (1) or (2), find L(f) if f(t) if equals: t cos 4t

-

Distinguish between the following pairs of items that appear on operating statements: (a) Gross sales and net sales, (b) Purchases at billed cost and purchases at net cost.

-

How does gross margin differ from gross profit? From net profit?

-

Explain the similarity between markups and gross margin. What connection do markdowns have with the operating statement?

-

A company has two routers RTA and RTB in their HQ. RTB is connected to remote office over a slow serial link. The remote office network is 192.168.1.0/24. If this link breaks down, both ISP and RTA...

-

A wilderness guide is escorting a college professor and one of his students through a remote jungle. The student, as always, has brought along his Xbox. Suddenly, the group encounters a pack of...

-

Look at the exhibit below in OSPF topology. Router R1 does not see the external route 200.200.200.0/24 in its routing table. You can see the external route in R2. How will you rectify this situation...

Study smarter with the SolutionInn App