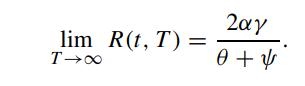

Consider the yield to maturity R(t, T) corresponding to the CoxIngersoll Ross model. Show that [see (7.2.32a,b)]

Question:

Consider the yield to maturity R(t, T) corresponding to the Cox–Ingersoll– Ross model. Show that [see (7.2.32a,b)]

Explain why an increase in the current short rate increases yields for all maturities, but the effect is more significant for shorter maturities, while an increase in the steady state mean γ increases all yields but the effect is more significant for longer maturities. What would be the effect on the yields when the short rate variance ρ2 and the market price of risk λ increase?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: