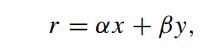

For the two-factor CIR model proposed by Longstaff and Schwartz (1992), the short rate r(t) is defined

Question:

For the two-factor CIR model proposed by Longstaff and Schwartz (1992), the short rate r(t) is defined by

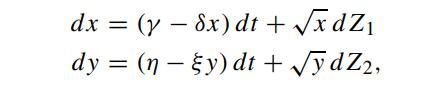

where α and β are positive constants, and α = β. Under the risk neutral measure, the risk factors x and y are governed by

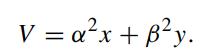

where Z1 and Z2 are uncorrelated standard Brownian processes. Let V denote the instantaneous variance of changes in the short rate.

where Z1 and Z2 are uncorrelated standard Brownian processes. Let V denote the instantaneous variance of changes in the short rate.

(a) Show that

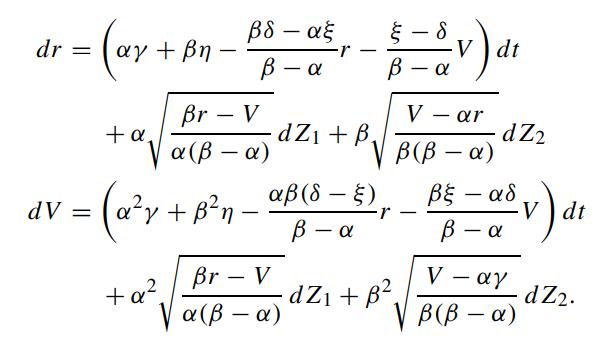

(b) Using Ito’s lemma, show that the dynamics of r and V are governed by

Note that r and V together form a joint Markov process.

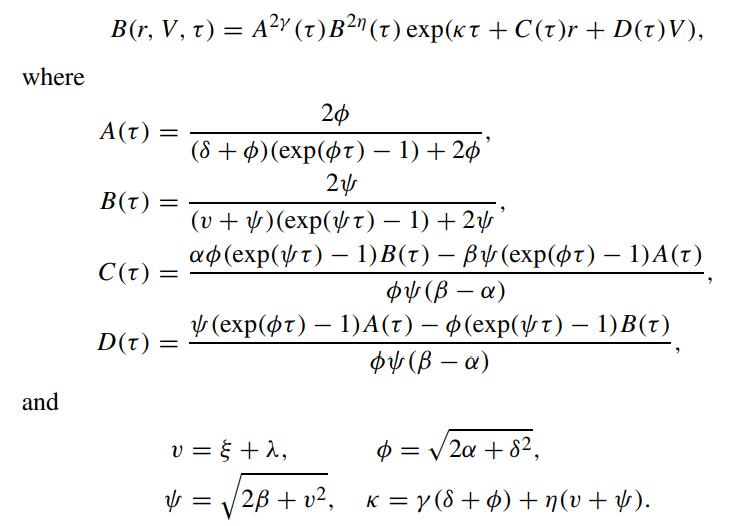

(c) Show that r has a long-run stationary (unconditional) distribution with mean

![and variance E[r] var(r) = + + 282 22](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/2/7/966655d85fe4fafa1700627963026.jpg) Similarly, show that V also has a stationary distribution with mean

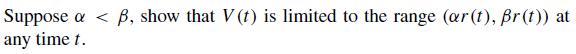

Similarly, show that V also has a stationary distribution with mean

![and variance ELVI-/+ E[V] = var(V) = 'n + 282 22](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/2/7/984655d86105dfc21700627981038.jpg)

(d) Let B(r,V,τ) denote the price function of a unit discount bond with τ periods until maturity. Show that

(e)

(e)

Step by Step Answer: