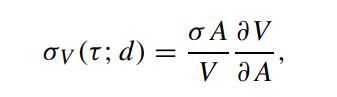

In the Merton model of risky debt, suppose we define which gives the volatility of the value

Question:

In the Merton model of risky debt, suppose we define

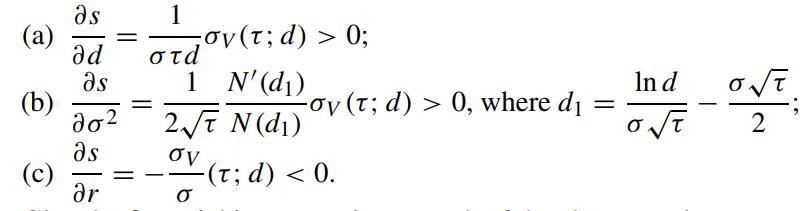

which gives the volatility of the value of the risky debt. Also, we denote the credit spread by s(τ ; d), where s(τ ; d) = Y(τ) − r. Show that (Merton, 1974)

Give the financial interpretation to each of the above results.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: