Let P () denote the European put price normalized by the asset price, that is, We

Question:

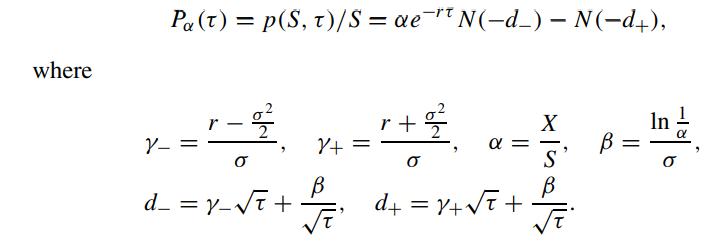

Let Pα(τ) denote the European put price normalized by the asset price, that is,

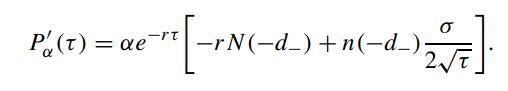

We would like to explore the behavior of the temporal rate of change of the European put price. The derivative of Pα(τ) with respect to τ is found to be

We would like to explore the behavior of the temporal rate of change of the European put price. The derivative of Pα(τ) with respect to τ is found to be

Define f (τ) by the relation P′α(τ) = αe−rτ f (τ), and the quadratic polynomial p2(τ) by

![P(t) =Y-Y+T - [B(y_ +y+) + 1]t + B. Let T and 72 denote the two real roots of p2(t), where t < t2, and let to](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/7/5/698655b3332378981700475694316.jpg)

(b) When none of the above conditions (i)–(iii) hold, then P′α (τ) ≤ 0 for all τ ≥ 0.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: