Let Q be the martingale measure with the money market account as the numeraire and Q

Question:

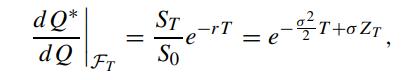

Let Q be the martingale measure with the money market account as the numeraire and Q∗ denote the equivalent martingale measure where the asset price St is used as the numeraire. Suppose St follows the Geometric Brownian process with drift rate r and volatility σ under Q, where r is the riskless interest rate. By using (3.2.11), show that

where ZT is Q-Brownian. Using the Girsanov Theorems, show that

![is Q*-Brownian. Explain why Z = ZTOT T (n + + (r + $ ) 7 ). ONT EQ* [1{ST>X}] = N(](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/6/8/978655b18f2d35d21700468975805.jpg)

then deduce that [see (3.3.12b)]

![In Eq[ST1{ST>X}] = erT SON v * 1). + (r + 2/2/) ONT](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/4/6/9/013655b19155dbab1700469011129.jpg)

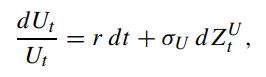

Let Ut be another asset whose price dynamics under Q is governed by

where dZUt dZt = ρdt and ρ is the correlation coefficient. Show that

is a Q∗-Brownian process.

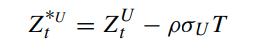

Since dZUt and dZt are correlated with correlation coefficient ρ, we may write

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: