Show that the lower and upper bounds on the difference between the prices of the American call

Question:

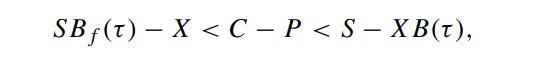

Show that the lower and upper bounds on the difference between the prices of the American call and put options on a foreign currency are given by

where Bf (τ) and B(τ) are bond prices in the foreign and domestic currencies, respectively, both with par value of unity in the respective currency and time to maturity τ,S is the spot domestic currency price of one unit of foreign currency.

To show the left inequality, consider the values of the following two portfolios: the first one contains a European currency call option plus X dollars of domestic currency, the second portfolio contains an American currency put option plus Bf (τ) units of foreign currency. To show the right inequality, we choose the first portfolio to contain an American currency call option plus XB(τ) dollars of domestic currency, and the second portfolio to contain a European currency put option plus one unit of the foreign currency.

Step by Step Answer: