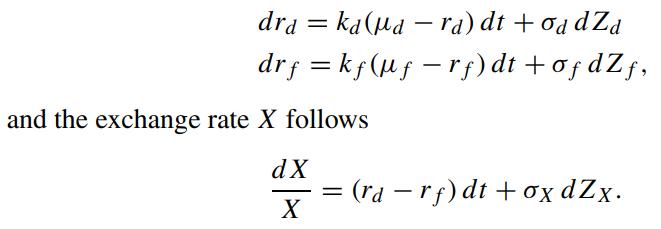

Under the risk neutral measure, suppose the dynamics of the domestic interest rate r d and foreign

Question:

Under the risk neutral measure, suppose the dynamics of the domestic interest rate rd and foreign interest rate rf follow the mean-reversion processes:

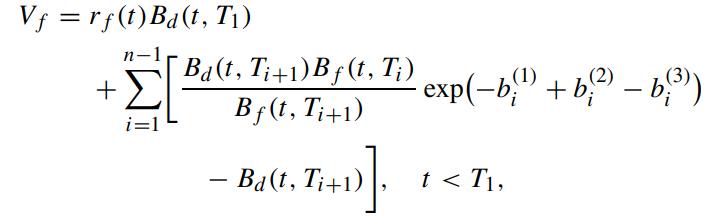

Let ρdf and ρfX denote the correlation coefficient between the domestic and foreign interest rates, and between the foreign interest rate and exchange rate, respectively. Taking the notional to be unity and assuming that the interest payment to be paid at T1 is known at time t, show that the sum of the present values at time t of all future interest payments based on the foreign LIBORs in a differential swap is given by (Wei, 1994; Chang, Chung and Yu, 2002)

Let ρdf and ρfX denote the correlation coefficient between the domestic and foreign interest rates, and between the foreign interest rate and exchange rate, respectively. Taking the notional to be unity and assuming that the interest payment to be paid at T1 is known at time t, show that the sum of the present values at time t of all future interest payments based on the foreign LIBORs in a differential swap is given by (Wei, 1994; Chang, Chung and Yu, 2002)

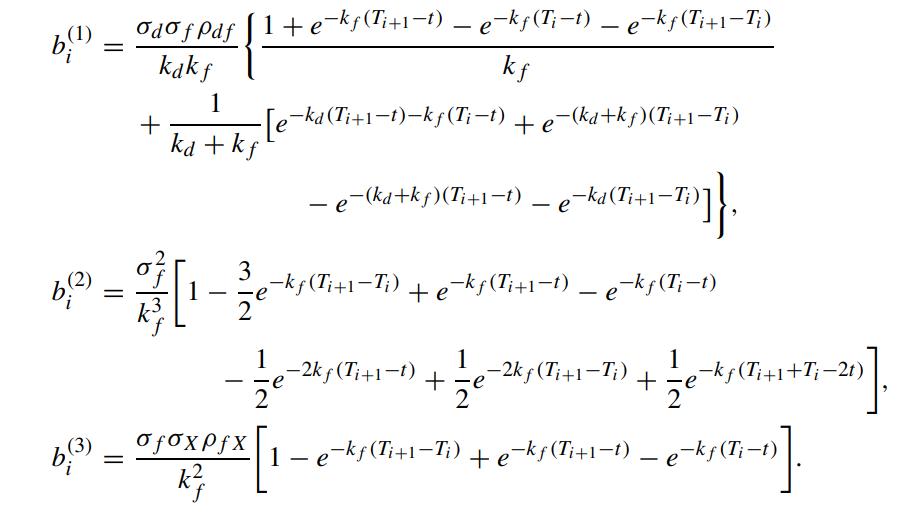

where Bd (t, Ti) and Bf (t, Ti) are the Ti-maturity domestic and foreign bond discount prices, respectively, and

Using financial arguments, explain why ρdf and ρfX enter into the pricing formula, and the differential swap would be worth something even if the domestic and foreign forward rates are the same and evolve with perfect correlation.

Using financial arguments, explain why ρdf and ρfX enter into the pricing formula, and the differential swap would be worth something even if the domestic and foreign forward rates are the same and evolve with perfect correlation.

Step by Step Answer: