We would like to examine the credit yield spreads of the floating rate debt and fixed rate

Question:

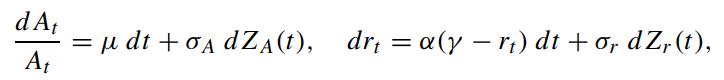

We would like to examine the credit yield spreads of the floating rate debt and fixed rate debt under the Merton risky bond model with stochastic interest rate (Ikeda, 1995). Let At and rt denote the firm asset value and short rate, respectively, whose dynamics are governed by

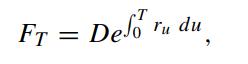

and dZA dZr = ρ dt. For the defaultable fixed rate debt, the payoff at debt’s maturity T is given by min(AT ,F), where F is the fixed par value. However, the par at maturity of a floating rate debt is stochastic, whose value is given by

for some constant D. The stochastic par is equivalent to the value of the money market account invested for T years with initial deposit D. Let B(r,t; T) denote the price of the corresponding default free discount bond and let σB(r, t; T) denote the corresponding bond volatility.

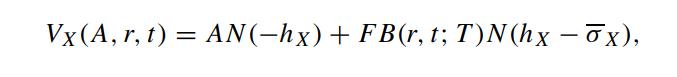

(a) Show that the value of the defaultable fixed rate debt at the current time t conditional on At = A and rt = r is given by

where

where

![Inkx + hx = ox 2 T 0} = [" [0 + 20(r, u; T) + 0}(r, u; T)] du. kx = B(r, t; T) F A](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/6/3/4/990655da16e241031700634989688.jpg)

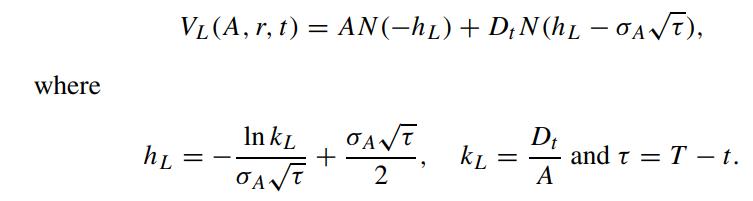

(b) Write Dt = De∫t0 r(u) du, which is known at time t from the actual realization of the interest rate process from 0 to t. Show that the value of the defaultable floating rate debt is given by

Interestingly, the bond volatility does not enter into VL(A,r,t). Why?

Let Y(r,t; T) denote the value of the money market account with initial deposit D. The evolution dynamics of Y(t) are given by dY = rtY dt. Use B(r,t; T) and Y(r,t; T) as the corresponding numeraire in the fixed rate debt and floating rate debt valuation, respectively.

Step by Step Answer: