Darlene Inc. purchased 20,000 common shares (20%) of Carlyle Ltd. on January 1, Year 4, for $260,000.

Question:

Darlene Inc. purchased 20,000 common shares (20%) of Carlyle Ltd. on January 1, Year 4, for $260,000. It did not have significant influence over Carlyle. It elected to classify the investment as fair value through OCI. On September 30, Year 5, Darlene obtained significant influence when there was a restructuring of the Board of Directors. Accordingly, Darlene adopted the equity method on a prospective basis.

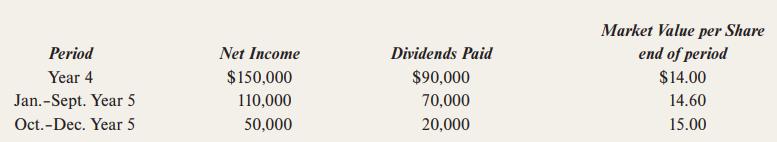

Additional information on Carlyle for the two years ending December 31, Year 5, is as follows:

On January 1, Year 6, Darlene sold its investment in Carlyle for $300,000.

Required

(a) Calculate the balance in the investment account at the end of each period.

(b) Calculate the profit and OCI to be reported each period.

(c) Prepare the journal entries for the sale of the shares and the transfer of OCI to retained earnings on January 1, Year 6.

Period Year 4 Jan.-Sept. Year 5 Oct.-Dec. Year 5 Net Income $150,000 110,000 50,000 Dividends Paid $90,000 70,000 20,000 Market Value per Share end of period $14.00 14.60 15.00

Step by Step Answer:

a b c Period Year 4 JanSept Year 5 OctDec Year 5 ...View the full answer

Modern Advanced Accounting In Canada

ISBN: 9781260881295

10th Edition

Authors: Hilton Murray, Herauf Darrell

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Jay, a public limited company, has acquired the following shareholdings in Gee and Hem, both public limited companies. The following statement of financial positions relate to Jay, Gee and Hem at 31...

-

On January 1 of the current year, Sheena Company purchased 30 percent of the outstanding common stock of Maryn Corporation at a total cost of $485,000. Management intends to hold the stock for the...

-

On January 1, 2014, Woodrow Company purchased 30 percent of the outstanding common shares of Trevor Corporation at a total cost of $ 560,000. Management intends to hold the stock for the long term....

-

The Policy Committee of your company decides to change investment strategies. This change entails an increase in exposure to the stocks of large companies producing consumer products dominated by...

-

What is the purpose of closing entries? Consider the consequence of forgetting to make closing entries.

-

Anderson acquires 10 percent of the outstanding voting shares of Barringer on January 1, 2011, for $92,000 and categorizes the investment as an available-for-sale security. An additional 20 percent...

-

As a gambling facility, MGM Desert Inn, Inc., regularly holds and executes negotiable instruments. During a period of two months, patron William E. Shack Jr. entered MGM and delivered eight checks to...

-

Stan Weakly can sort a bin of 100 letters in 10 minutes. He typically receives 600 letters an hour. A truck arrives with more bins every 30 minutes. The office uses a safety factor of 10%. How many...

-

What do you mean by Hardware Software Interface? Give a concrete example. Define the two principle integrity rules for the relational model. Discuss why it is desirable to enforce these rules.

-

The balance sheets of Rodriguez Ltd. and Vancouver Co. on December 31, Year 2, just before the transaction described below, were as follows: On December 31, Year 2, Rodriguez purchased 100% of...

-

Assume that the subsidiary purchased 30% of the parents bonds in the open market at a cost in excess of the carrying amount of the bonds. Briefly explain whether this event will increase, decrease or...

-

If your salary were to increase at a rate of 3% per year, determine your salary during your 10th year if your original salary was $35,000. (Use a 1 = 35,000, r = 1.03, and n = 10.)

-

Given the nested if-else structure below, what will be the value of after code execution completes x = 0 a = 0 b = -5 if a > 0: if b < 0: x = x + 5 elif a 5: X = X + 4 else: X = X + 3 else: x = x +...

-

Certain bacteria cells are being observed in an experiment. The population triples in 1 hour. If at the end of 3 hours, the population is 27,000, how many bacteria cells were present at the start of...

-

Consider a flat plate of thickness 0.3 m submerged in water (f=1000 kg/m 3 ) with the plate parallel to the free surface. The area of the top (and also bottom) surface of the plate is 0.005 m 2 ....

-

Marketing exists to ensure customer satisfaction is granted. However, the term customer can be in many forms and each of them reflecting different characteristics and behaviours. With examples,...

-

What will the reading on the Richter scale be for an earthquake that has an intensity of 3.8 x 10^6 and a reference value of 1?

-

In the Ardmore Hotel, 20 percent of the guests (the historical percentage) pay by American Express credit card. (a) What is the expected number of guests until the next one pays by American Express...

-

The production budget of Artest Company calls for 80,000 units to be produced. If it takes 30 minutes to make one unit and the direct labor rate is $16 per hour, what is the total budgeted direct...

-

The directors of Atlas Inc. and Beta Corp. have reached an agreement in principle to merge the two companies and create a new company called AB Ltd. The basics of the agreement confirmed so far are...

-

Manitoba Peat Moss (MPM) was the first Canadian company to provide a reliable supply of high-quality peat moss to be used for greenhouse operations. Owned by Paul Parker, the company's founder and...

-

When Conoco Inc. of Houston, Texas, announced the CDN$7 billion acquisition of Gulf Canada Resources Limited of Calgary, Alberta, a large segment of the press release was devoted to outlining all of...

-

5. Let A, B and C be 3 3 matrices so that det A = det B = 0 and det C = 2. Determine det((2A-CBT)T).

-

f(x) = 128x + 384 Find the equation of the tangent line to the graph of the function at x = 1. Answer in ma + b form. L(x) = = Use the tangent line to approximate f(1.1). L(1.1) = Compute the actual...

-

Find equations for the tangent lines and the normal lines to the hyperbola for the given value of x. (The normal line at a point is perpendicular to the tangent line at the poin x- y = 1, x = 6 (a)...

Study smarter with the SolutionInn App