On December 31, Year 1, Peter Holdings Company purchased 100% of the outstanding shares of Kamsack Company

Question:

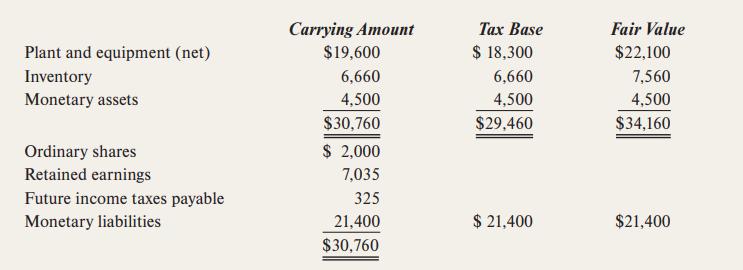

On December 31, Year 1, Peter Holdings Company purchased 100% of the outstanding shares of Kamsack Company for $12,900 cash. Three different values for Kamsack’s balance sheet accounts on the date of acquisition were as follows:

Peter reported future income taxes payable of $2,300 at December 31, Year 1. All differences between carrying amount and the tax base are temporary differences for the items listed above. Any goodwill reported on the consolidated balance sheet is redundant for tax purposes. The enacted tax rate for both companies is 30% for Year 1 and will decrease to 25% in Year 2.

Required

(a) Calculate future income taxes payable and noncontrolling interest for the consolidated balance sheet at the date of acquisition.

(b) Now assume that Peter only acquired 80% of Kamsack for $10,500. Calculate future income taxes payable and noncontrolling interest for the consolidated balance sheet at the date of acquisition.

Step by Step Answer:

Modern Advanced Accounting In Canada

ISBN: 9781260881295

10th Edition

Authors: Hilton Murray, Herauf Darrell