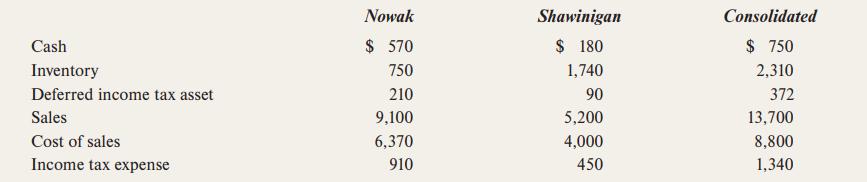

Selected accounts from the year-to-date financial statements for Nowak Company and its wholly owned subsidiary, Shawinigan Ltd.,

Question:

Selected accounts from the year-to-date financial statements for Nowak Company and its wholly owned subsidiary, Shawinigan Ltd., were as follows:

Additional Information

• The above statements include the only intercompany transaction this year which was a cash sale of $600 by Nowak to Shawinigan at its regular margin of 30% of sales and accrued income tax at its tax rate of 40%.

• Today, Shawinigan sold $400 of the inventory it had purchased from Nowak to an arm’s length party at its regular markup of 30% over cost and accrued income tax at its tax rate of 40%.

Required

Determine the account balance for each account on the three financial statements after the new transaction is recorded.

Step by Step Answer:

Modern Advanced Accounting In Canada

ISBN: 9781260881295

10th Edition

Authors: Hilton Murray, Herauf Darrell