A Company owns 75% of B Company and 40% of C Company. B Company owns 40% of

Question:

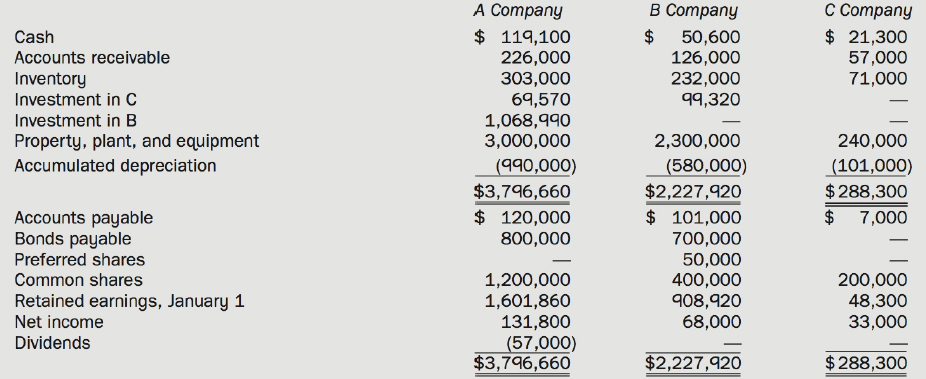

A Company owns 75% of B Company and 40% of C Company. B Company owns 40% of C Company. The following information was assembled at December 31, Year 7.

Additional Information:

• A Company purchased its 40% interest inc Company on January 1, Year 4. On that date, the negative acquisition differential of $42,500 on the 40% investment was allocated to equipment with an estimated useful life of 10 years.

• A Company purchased its 75% of B Company's common shares on January 1, Year 6. On that date, the 100% implied acquisition differential was allocated $40,000 to buildings with an estimated useful life of 20 years, and $89,600 to patents to be amortized over eight years. The preferred shares of B Company are non-cumulative.

• On January 1, Year 6, B Company's accumulated depreciation was $450,000.

• On January 1, Year 7, B Company purchased its 40% interest in C Company for $99,320. The carrying amount of C Company's identifiable net assets approximated fair value on this date and C Company's accumulated depreciation was $52,700.

• The inventory of B Company contains a profit of $7,600 on merchandise purchased from A Company. The inventory of A Company contains a profit of $6,900 on merchandise purchased from C Company.

• On December 31, Year 7, A Company owes $33,000 to C Company and B Company owes $4,000 to A Company.

• Both A Company and B Company use the equity method to account for their investments but have made no equity method adjustments in Year 7.

• An income tax rate of 40% is used for consolidation purposes.

Required

(a) Calculate non-controlling interest's share of consolidated net income for Year 7.

(b) Prepare a consolidated statement of retained earnings for Year 7.

(c) Prepare a consolidated balance sheet as at December 31, Year 7. Show all calculations.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell