Brandt Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2023, with

Question:

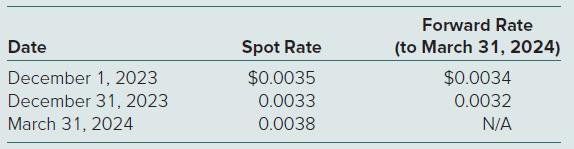

Brandt Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2023, with payment of 10 million South Korean won to be received on March 31, 2024. The following exchange rates apply:

a. Assuming that Brandt did not hedge its foreign exchange risk, determine how much foreign exchange gain or loss the company should report on its 2023 income statement with regard to this transaction.

b. Assuming that Brandt entered into a forward contract to sell 10 million South Korean won on December 1, 2023, as a fair value hedge of a foreign currency receivable, determine the net impact on net income in 2023 resulting from a fluctuation in the value of the won. Brandt amortizes forward points on a monthly basis using a straight-line method. Ignore present values.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik