Goal Products Limited (GPL) is the official manufacturer and distributor of soccer balls for the North American

Question:

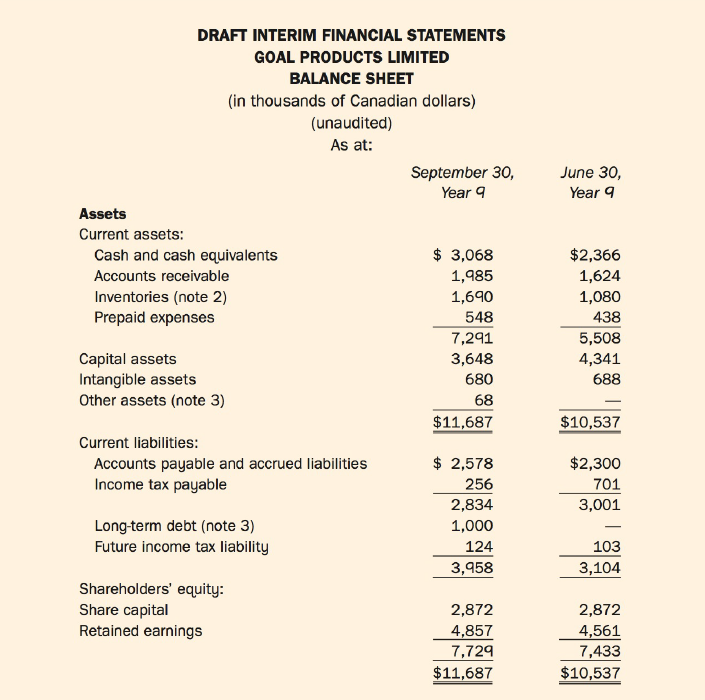

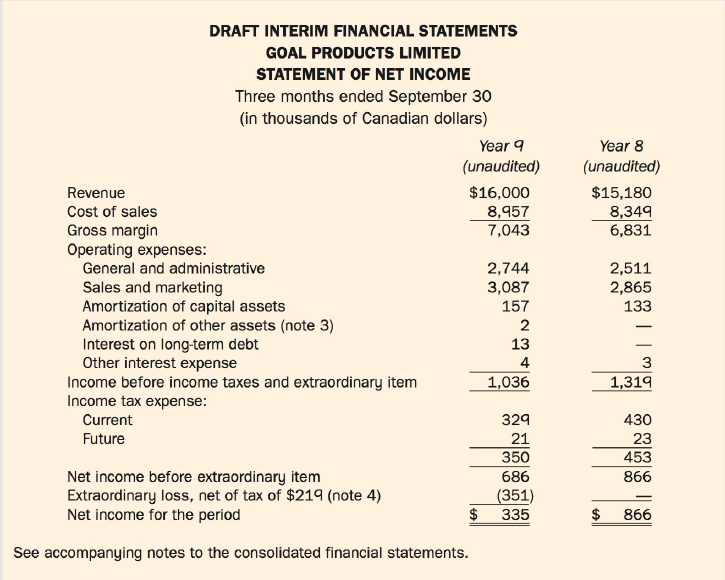

Goal Products Limited (GPL) is the official manufacturer and distributor of soccer balls for the North American League Soccer (NALS), a professional soccer association. GPL is a private company. It has always prepared its financial statements in accordance with ASPE. It is now October 20, Year 9. You, CPA, were recently hired as the manager of financial reporting for GPL. In your first week, you must review the first draft of the quarterly financial statements and provide comments to the financial reporting team on any issues you note. As you start your review you receive an email from the chief financial officer, Joey Bonaducci (Exhibit II). The quarterly financial statements, for the period ended September 30, Year 9, are still being finalized. So far you have received the balance sheet, statement of net income, and most of the planned note disclosures (Exhibit III) that will be provided to GPL's major lenders. You have received as well an internally prepared highlights summary (Exhibit IV) that will also be provided to GPL's major lenders. The statements of retained earnings and cash flows and the disclosures of changes in accounting policies are still being finalized.

Exhibit II:

EMAIL FROM JOEY BONADUCCI

Hi CPA,

As you may know, we are planning to transition for ASPE to I FRS in the near future. I've just returned from a conference on current issues facing private companies transitioning to I FRS. I don't think the transition will be difficult. The changes I've noted so far affect impairment of assets and extraordinary items. I'd like you to tell me how those IFRS would specifically apply to our most recent quarterly financial statements. You should also prepare a brief analysis that highlights any other major differences between ASPE policies and IFRS that are relevant for GPL.

See accompanying notes to the consolidated financial statements.

GOAL PRODUCTS LIMITED

NOTES TO DRAFT INTERIM FINANCIAL STATEMENTS

For the period ended September 30, Year 9

(unaudited)

1. Basis of Presentation:

These interim financial statements were prepared using accounting policies and methods consistent with those used in the preparation of the Company's audited financial statements for the year ended June 30, Year 9. These interim financial statements conform in all respects to the requirements of Canadian generally accepted accounting principles for annual financial statements for private companies, with the exception of certain note disclosures, and should be read in conjunction with the Company's audited financial statements and notes for the year ended June 30, Year 9.

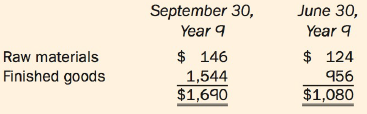

2. Inventories (In thousands):

3. Long-Term Debt:

On July 1, Year 9, the Company entered into a $1 mill ion, 10-year term loan bearing interest at 5%. Interest is payable quarterly. The principal of the debt can be converted, at the option of the lender, into 200,000 common shares of GPL at any time prior to maturity. The principal amount of the loan is due on July 1, 2019.

Debt issue costs of $70,000 were incurred in relation to the loan agreement and have been capitalized to Other assets. The costs are being amortized over the term of the loan using the effective interest rate method.

4. Extraordinary Item:

During the three months ended September 30, Year q, the Company experienced a loss of $570,000 before tax as a result of a fire that bumed a fleet of trucks containing several large shipments of soccer balls.

INTERNALLY PREPARED HIGHLIGHTS SUMMARY:

Revenue for Q1 (July to September Year q) includes $900,000 booked for a special shipment of balls to the Pan-America Cup (PAC) at the end of the quarter. Title and risk of loss for the balls transferred once they were shipped, and we have invoiced the PAC committee for the full amount. The committee does not have to pay for the balls until they are sold at the PAC in November. They can return any unsold balls, but we are confident they will sell out.

General and administrative expenses increased because we hired three supervisors. We discussed the treatment of the fleet truck fire as an extraordinary item with the external auditors, which they judged to be correct.

In July, we were sued by one of our suppliers for non-payment for a shipment of leather. After using the leather in the production process, we realized it was below our quality standards. The supplier is claiming for damages as well as loss of revenue in the amount of approximately $800,000. Legal counsel thinks the chance we will lose is just over 75%. If we lose, counsel believes we will have to pay the full claim. We think the court proceedings will be resolved by the end of our fiscal year. We are accruing $150,000 (25% of our probability estimate) so we will have $600,000 accrued by year-end.

The outlook for the rest of the year appears strong. We expect to operate the plant at capacity and produce approximately 2 million soccer balls. Consistent with other years, we expect Q1 and Q2 to have si gnifcantly higher sales and profits since these are our peak sale times (NALS pre-season and regular season).

During the year ended June 30, Year q, we experienced a manufacturing equipment malfunction . Management determined the value of the equipment had permanently declined, and booked an impairment loss of $160,000 in the year. Recently, we think we located the critical part needed to make the equipment serviceable again, and will receive the part next month.

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell