On December 1, 2020, Venice Company (a U.S.-based company) entered into a three-month forward contract to purchase

Question:

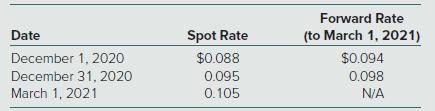

On December 1, 2020, Venice Company (a U.S.-based company) entered into a three-month forward contract to purchase 1,000,000 pesos on March 1, 2021. The following U.S. dollar per peso exchange rates apply:

Ignoring present values, which of the following correctly describes the manner in which Venice Company will report the forward contract on its December 31, 2020, balance sheet?

a. As an asset in the amount of $1,000

b. As an asset in the amount of $4,000

c. As a liability in the amount of $1,000

d. As a liability in the amount of $4,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

Question Posted: