On January 1, 2019, Cayce Corporation acquired 100 percent of Simbel Company for consideration transferred with a

Question:

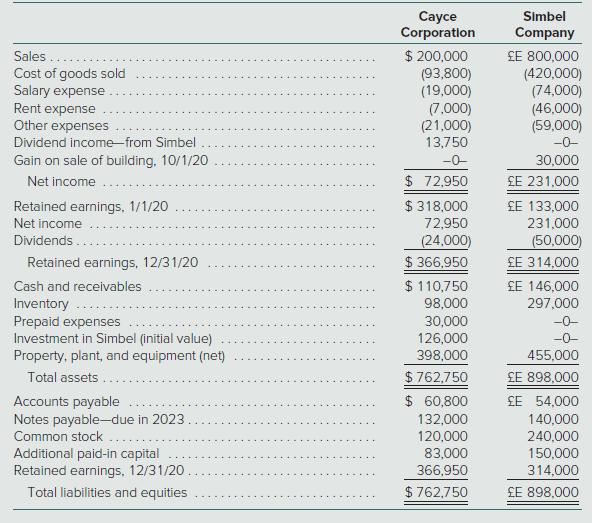

On January 1, 2019, Cayce Corporation acquired 100 percent of Simbel Company for consideration transferred with a fair value of $126,000. Cayce is a U.S.-based company headquartered in Buffalo, New York, and Simbel is in Cairo, Egypt. Cayce accounts for its investment in Simbel under the initial value method. Any excess of fair value of consideration transferred over book value is attributable to undervalued land on Simbel’s books. Simbel had no retained earnings at the date of acquisition. The following are the 2020 financial statements for the two operations. Information for Cayce and for Simbel is in U.S. dollars ($) and Egyptian pounds (£E), respectively.

Additional Information

- During 2019, the first year of joint operation, Simbel reported income of £E 163,000 earned evenly throughout the year. Simbel declared a dividend of £E 30,000 to Cayce on June 1 of that year. Simbel also declared the 2020 dividend on June 1.

- On December 9, 2020, Simbel classified a £E 10,000 expenditure as a rent expense, although this payment related to prepayment of rent for the first few months of 2021.

The exchange rates for 1 £E are as follows:

January 1, 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.300

June 1, 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.290

Weighted average rate for 2019 . . . . . . . . . . . . . . . . . . . . . . . 0.288

December 31, 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.280

June 1, 2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.275

October 1, 2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.273

Weighted average rate for 2020 . . . . . . . . . . . . . . . . . . . . . . . 0.274

December 31, 2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.270

Translate Simbel’s 2020 financial statements into U.S. dollars and prepare a consolidation worksheet for Cayce and its Egyptian subsidiary. Assume that the Egyptian pound is the subsidiary’s functional currency.

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik