On January 1, 2019, Telconnect acquires 70 percent of Bandmor for $490,000 cash. The remaining 30 percent

Question:

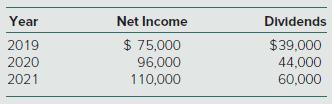

On January 1, 2019, Telconnect acquires 70 percent of Bandmor for $490,000 cash. The remaining 30 percent of Bandmor’s shares continued to trade at a total value of $210,000. The new subsidiary reported common stock of $300,000 on that date, with retained earnings of $180,000. A patent was undervalued in the company’s financial records by $30,000. This patent had a five-year remaining life. Goodwill of $190,000 was recognized and allocated proportionately to the controlling and noncontrolling interests. Bandmor earns net income and declares cash dividends as follows:

On December 31, 2021, Telconnect owes $22,000 to Bandmor.

a. If Telconnect has applied the equity method, what consolidation entries are needed as of December 31, 2021?

b. If Telconnect has applied the initial value method, what Entry *C is needed for a 2021 consolidation?

c. If Telconnect has applied the partial equity method, what Entry *C is needed for a 2021 consolidation?

d. What noncontrolling interest balances will appear in consolidated financial statements for 2021?

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik