On January 1, 2020, a new Board of Directors was elected for Bradley Hospital. The new board

Question:

On January 1, 2020, a new Board of Directors was elected for Bradley Hospital. The new board switched to a different accountant. After reviewing the hospital?s books, the accountant decided that the accounts should be adjusted. Effective January 1, 2020, the board decided that?

1. Separate funds should be established for the General Fund, the Bradley Endowment Fund, and the Plant Replacement and Expansion Fund (the old balances will be reversed to eliminate them).

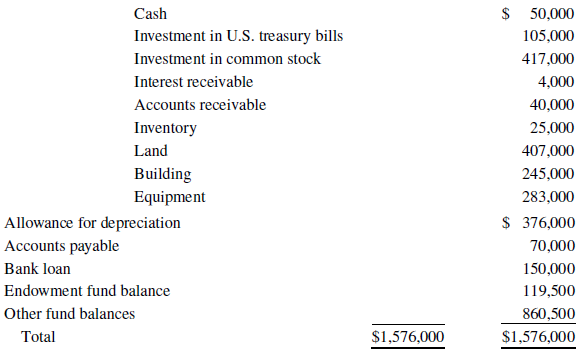

2. The accounts should be maintained in accordance with fund accounting principles. The balances in the general ledger at January 1, 2020, are presented here:

The following additional information is available:

1. Under the terms of the will of J. Ethington, founder of the hospital, ?The principal of the bequest is to be fully invested in trust forevermore in mortgages secured by productive real estate in Central City and/or in U.S. Government securities . . . and the income therefrom is to be used to defray current expenses.?

2. The Endowment Fund consists of the following:

Cash received in 1898 by bequest from Ethington .................................................... ? ?$ 81,500

Net gains realized from 1956 through 1989 from the sale of real estate

acquired in mortgage foreclosures .............................................................................? ? ? ? 23,500

Income received from 1990 through 2019 from 90-day U.S. treasury

bill investments ..............................................................................................................? ? ? ? 14,500

Balance per general ledger on January 1, 2020 ......................................................... ? ?$119,500

3. The land account balance is composed of 1900 appraisal of land at?

$10,000 and building at $5,000, received by donation at that time.?

The building was demolished in 1934. .................................................... ? ?$ 15,000Appraisal increase based on insured value in land title policiesissued in 1954. ........................................................................................... ? ? ?380,000Landscaping costs for trees planted. ...................................................... ? ? ? ?12,000Balance per general ledger on January 1, 2020 ..................................... ? ?$407,000

4. The building balance is composed of Cost of present hospital building?

completed in January 1974, when the hospital commenced operations. ....................... ?$ 300,000Adjustment to record appraised value of building in 1984. ............................................. ? ? (100,000)Cost of elevator installed in hospital building in January 2000. ....................................... ? ? ? ? 45,000Balance per general ledger on January 1, 2020. ................................................................ ? ?$ 245,000

The estimated useful lives of the hospital building and the elevator when new were 50 years and 20 years, respectively.

5. The hospital?s equipment was inventoried on January 1, 2020. The costs shown in the inventory agreed with the equipment account balance in the general ledger. The allowance for depreciation account at January 1, 2020, included $158,250 applicable to equipment, and that amount was determined to be accurate. All depreciation is computed on a straight-line basis.

6. A bank loan was obtained to finance the cost of new operating room equipment purchased in 2011. Interest was paid to December 31, 2019.

7. Common stock with a market value of $417,000 was donated to Bradley Hospital with the stipulation that the proceeds from the sale of the stock must be used for facilities expansion. The hospital plans to undertake expansion of its facilities next year and to sell these securities at that time.

Required:

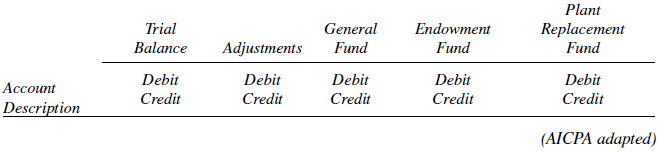

Using the workpaper form below, prepare the entries necessary to establish the correct balances as of January 1, 2020.

Step by Step Answer: