On January 1, 2022, Pride Corporation purchased 90 percent of the outstanding voting shares of Star, Inc.,

Question:

On January 1, 2022, Pride Corporation purchased 90 percent of the outstanding voting shares of Star, Inc., for $540,000 cash. The acquisition-date fair value of the noncontrolling interest was $60,000. At January 1, 2022, Star’s net assets had a total carrying amount of $420,000. Equipment (8-year remaining life) was undervalued on Star’s financial records by $80,000. Any remaining excess fair value over book value was attributed to unpatented technology developed by Star (4-year remaining life), but not recorded on its books. Star recorded net income of $70,000 in 2022 and $80,000 in 2023. Each year since the acquisition, Star has declared a $20,000 dividend. At January 1, 2024, Pride’s retained earnings show a $250,000 balance.

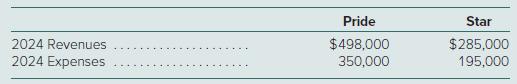

Selected account balances for the two companies from their separate operations were as follows:

Assuming that Pride, in its internal records, accounts for its investment in Star using the equity method, what amount of retained earnings would Pride report on its January 1, 2024, consolidated balance sheet?a. $250,000b. $286,000c. $315,000d. $360,000

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik