Tesla announced on August 1, 2016, its intent to buy SolarCity in a deal expected to exceed

Question:

Tesla announced on August 1, 2016, its intent to buy SolarCity in a deal expected to exceed $2.5 billion dollars. Tesla touted the acquisition because of $150 million in expected cost synergies in the first year. In addition, the new company would be the world?s largest vertically integrated energy company (the company would be able to sell electric cars, make and sell energy storage for buildings and the grid, and make and install solar panels). SolarCity?s expertise in installing solar panels could bolster installations of Tesla?s Powerwalls (Tesla rechargeable Lithium-ion batteries used for domestic consumption). The acquisition is expected to be dilutive to EPS. Further, the combined debt of the two companies would be $6 billion, despite adding $1 billion in revenue to the combined company.

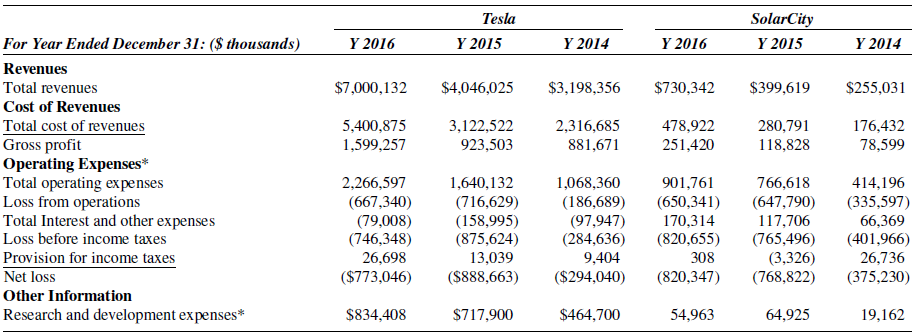

Financial statements for both companies at the end of 2016 are presented below. The acquisition did occur on November 21, 2016. The results for Tesla reported below do include the results of operations for SolarCity from the date of acquisition to the end of the current year (November 21 to December 31, 2016).

(1) What does it mean for an acquisition to be dilutive? Why would shareholders vote to approve the acquisition if the acquisition is expected to be dilutive? Why would management prefer the acquisition if it is dilutive?

(2) Provide comments concerning the performance of both companies. Why is it difficult to predict the success of the acquisition?

Step by Step Answer: