The following information is available for the assets of Saman Ltd. at December 31, Year 5: (The

Question:

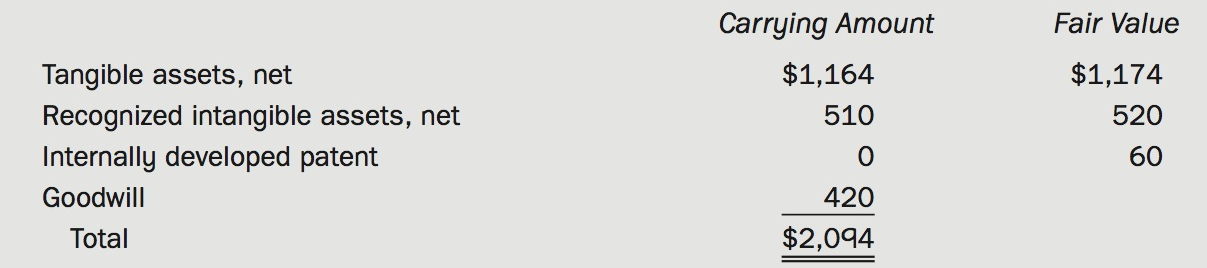

The following information is available for the assets of Saman Ltd. at December 31, Year 5:

(The following 3 parts are independent situations.)

Part A. Assume that the total fair value for all of Saman's assets as a group is $1,860.

(a) Calculate the total impairment loss for Year 5.

(b) After recognizing any impairment loss in (a), what are the reported carrying amounts for assets listed above?

Part B. Assume that the total fair value for all of Saman's assets as a group is $1,450.

(a) Calculate the total impairment loss for Year 5.

(b) After recognizing any impairment loss in (a), what are the reported carrying amounts for assets listed above?

Part C. Assume that Cyrus acquired all of Saman's assets for $1,860 as a business acquisition.

(a) Determine the amount to allocate to each of the assets listed above on the date of acquisition.

(b) Briefly explain why there is a difference in the amount of goodwill between Part A and Part C.

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell