Consider a static frictionless economy with a riskless asset in zero net supply with return (R_{f}), and

Question:

Consider a static frictionless economy with a riskless asset in zero net supply with return \(R_{f}\), and \(n\) risky assets with jointly normal returns \(R_{i}, i=1 \ldots n\). Suppose the risky returns obey a linear \(K\)-factor model:

where the factors and residuals are normally distributed, \(\bar{R}_{i}\) and \(b_{i k}\) are constants, \(\operatorname{Var}\left(\epsilon_{i}ight)=\sigma_{i}^{2}, \operatorname{Var}\left(f_{i}ight)=1\), and \(\mathrm{E}\left[\epsilon_{i}ight]=\mathrm{E}\left[f_{k}ight]=\operatorname{Cov}\left(\epsilon_{i}, \epsilon_{k}ight)=\operatorname{Cov}\left(\epsilon_{i}, f_{i}ight)=\operatorname{Cov}\left(\epsilon_{i}, f_{k}ight)=\) \(\operatorname{Cov}\left(f_{i}, f_{k}ight)=0\), for all \(i\) and \(k\) with \(k eq i\). There is a representative investor who has exponential utility with coefficient of absolute risk aversion \(A\). Assume that the representative investor has wealth \(W=1\).

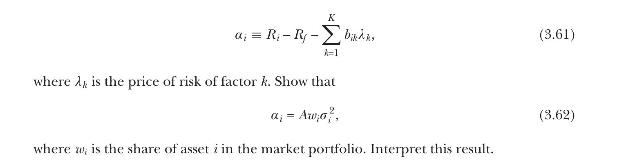

For each asset \(i\), define the deviation \(\alpha_{i}\) from the average excess return predicted by arbitrage pricing theory as

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell