A proposed brewery in the Central European country of Dubiety will produce a beer the Dubi Dubbel

Question:

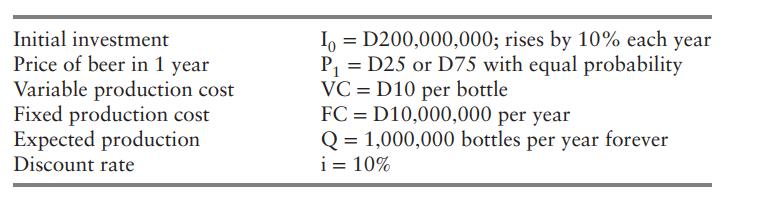

A proposed brewery in the Central European country of Dubiety will produce a beer— the “Dubi Dubbel”— for Grolsch N.V. of the Netherlands. A number of other European brewers have announced plans to produce and sell beer in the Dubi market. If too many breweries open, beer prices will fall. If some of these investment plans do not materialize, prices are likely to rise. The price of beer is determined exogenously and will be known with certainty in one year. Grolsch management must decide whether to begin production today or in one year. The following facts apply:

a. Draw a decision tree that depicts Grolsch’s investment decision.

b. Calculate the NPV of investing as if it were a now-or-never alternative.

c. Calculate the NPV (at t = 0) of waiting one year before deciding.

d. Calculate the NPV of investing today, including all opportunity costs.

e. Should Grolsch invest today or wait one year before making a decision?

Step by Step Answer: