Arcadia Ltd has only one product, a garden gnome, for which it plans to increase production and

Question:

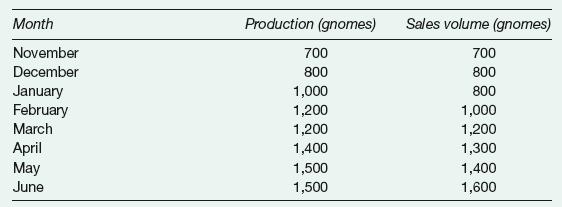

Arcadia Ltd has only one product, a garden gnome, for which it plans to increase production and sales during the first half of next year. The plans for the next eight months are as follows:

The selling price for each gnome will be £10. The raw materials will cost £4 per gnome; wages and other variable costs are expected to be £3 per gnome.

Salaries and other fixed overheads are expected to amount to £1,400 per month during November and December, to rise to £1,600 per month from January to April (inclusive) and to increase to £2,000 per month for May and June.

Sixty per cent of sales are made on a cash basis (paid on delivery). The remainder are on credit, customers being expected to pay in full in the second month after the sale.

Payment for raw material purchases will be made one month after delivery. Materials will be held in stock for one month before they are used in production.

Wages and other variable costs will be paid during the month of production. Salaries and other fixed overheads will be paid 80 per cent in the month in which they are incurred and 20 per cent in the following month.

To promote the expanded sales volume, an advertising campaign is to be undertaken.

This will involve payments to the advertising agency of £1,000 in January and £1,500 in April.

A new machine, to help cope with the increased production, has been ordered. This should be delivered in February. The agreement is to pay the £6,000 for the machine in three equal instalments of £2,000 each in March, April and May.

Arcadia Ltd intends to pay a dividend of £600 to its shareholders in April. It expects to have a bank current account balance (in funds) of £7,500 on 1 January.

Produce a cash budget for the first six months of next year, showing the net cash position at the end of each month.

Step by Step Answer: