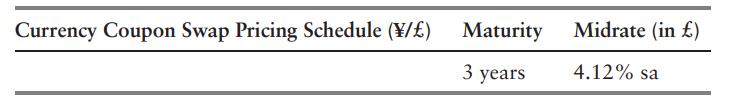

Consider the following swap pricing schedule for currency coupon swaps of yen and pounds. Deduct 5 bps

Question:

Consider the following swap pricing schedule for currency coupon swaps of yen and pounds.

Deduct 5 bps if the bank is paying a fixed rate. Add 5 bps if the bank is receiving a fixed rate. All quotes are against 6-month yen LIBOR flat. The spot rate is ¥240.00/£. Yield curves are flat and the pound is selling at a 6-month forward discount of 58 bps. Bonds in Japan and the United Kingdom are quoted as a bond equivalent yield.

a. What is the yen interest rate that corresponds to the 3-year pound swap mid-rate? Note that interest rates are compounded semiannually.

b. Japan Ink (JI) has ¥2.4 billion of 3-year yen debt at a floating rate of 6-month (¥) LIBOR + 105 bps (MMY), or 52.5 bps each six months. JI wants to swap into fixed rate pound debt to fund its U.K. operations using a fully covered currency coupon swap. What is the all-in cost of JI’s yen-for-pound currency coupon swap?

c. British Dog (BD) has 3-year fixed rate pound debt at 7.45 percent (BEY). BD wants floating rate yen to fund its expansion into Japan. What is the all-in cost of BD’s fully covered yen-for-pound swap?

d. What does the swap bank gain from these transactions?

Step by Step Answer: