Expansion plc has consistently expanded its activities over the past decade, partly through takeover and partly through

Question:

Expansion plc has consistently expanded its activities over the past decade, partly through takeover and partly through organic growth using retention of much of its annual profits. Consolidation plc operates in a mature, stable industry. Expansion plc is about to launch a takeover bid for the entire equity of Consolidation plc. The offer will be that Expansion plc will give one of its shares for every ten shares in Consolidation plc.

Analysts at Expansion plc believe that there are potential savings in total after-tax administrative costs of the merged operation, relative to the existing total administrative cost of the two businesses, totalling £10 million.

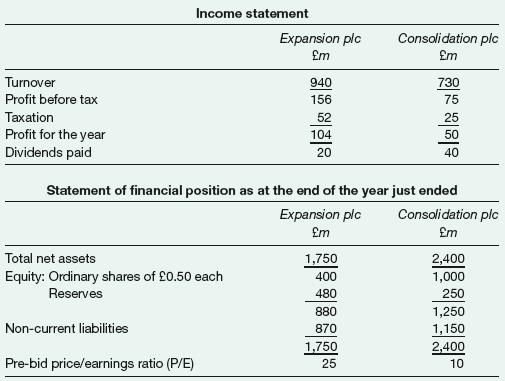

Summarised financial statements for the year just ended are as follows:

Observers believe that, following the takeover, the P/E ratio of Expansion plc will be 20. It seems likely that Expansion plc will continue to distribute the same proportion of its after-tax profits as in the most recent year.

Assuming that both sets of shareholders are concerned both with the level of dividends and with the market price of their shares, how would the shareholders of each business be likely to react to the takeover offer?

Step by Step Answer: