Heres a balance sheet for Silver Saddle Motel of Santa Fe, New Mexico. Silver Saddles accounts payable

Question:

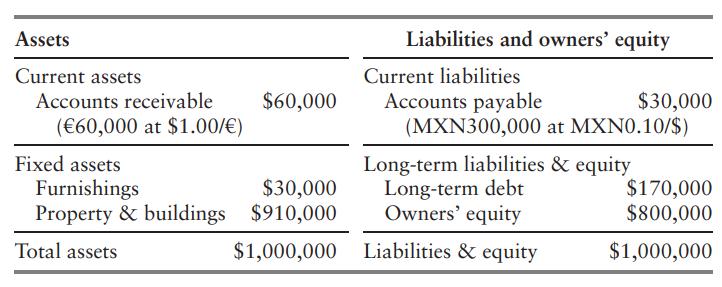

Here’s a balance sheet for Silver Saddle Motel of Santa Fe, New Mexico.

Silver Saddle’s accounts payable balance is a 300,000 Mexican peso (MXN) purchase of authentic Mexican rugs for use in the motel. The purchase is denominated in Mexican pesos (MXN) and was placed on the books at an exchange rate of $0.10/MXN. The balance is due in six months and is payable in Mexican pesos. To hedge this peso exposure, Silver Saddle decides to buy MXN 300,000 six months forward at a forward rate of $0.10/MXN.

a. What are Silver Saddle’s accounts if this forward transaction is capitalized on the balance sheet as a forward asset of MXN 300,000 (worth $30,000 at the $0.10/MXN forward exchange rate) and an offsetting forward liability of $30,000?

b. Calculate Silver Saddle’s current ratio (current assets divided by current liabilities) and debt-to-assets ratio (including all liabilities except owners’ equity in the numerator of the debt-to-assets ratio) before and after the forward contract is capitalized. Is Silver Saddle’s financial risk higher or lower after the Mexican peso liability is hedged? How do you reconcile this conclusion with the apparent deterioration in Silver Saddle’s debt-to-assets (leverage) and current (liquidity) ratios? Explain.

c. Can Silver Saddle qualify this hedge under the ASC 815 rules? What will Silver Saddle’s balance sheet look like if the forward currency transaction is accounted for as a hedge?

Step by Step Answer: