Hi Fido plc manufactures high fidelity sound reproduction equipment for the household market. It has recently spent

Question:

Hi Fido plc manufactures high fidelity sound reproduction equipment for the household market. It has recently spent £500,000 developing a new loudspeaker, called the Tracker. A decision now needs to be taken as to whether to go ahead with producing and marketing Trackers. This is to be based on the expected net present value of the relevant cash flows, discounted at the business’s estimate of the 20X0 weighted average cost of capital of 8 per cent (after tax). Management believes that a three-year planning horizon is appropriate for this decision, so it will be assumed that sales will not continue beyond 20X3.

Manufacture of Trackers would require acquisition of some plant costing £1 million, payable on installation, on 31 December 20X0. This cost would attract the normal capital allowances for plant and machinery. If the company makes the investment, for tax purposes the plant will be depreciated on a reducing balance basis at 25 per cent p.a., starting in the year of acquisition irrespective of the exact date of acquisition during the year. In the year of disposal, no tax depreciation is charged, but the difference between the written down value and the disposal proceeds is either given as an additional tax allowance or charged to tax depending on whether the written down value exceeds the disposal proceeds or vice versa. For the purposes of assessing the viability of the Tracker, it will be assumed that the plant would not have any disposal value on 31 December 20X3.

The first sales of Trackers would be expected to be made during the year ending 31 December 20X1. There is uncertainty as to the level of sales that could be expected, so a market survey has been undertaken at a cost of £100,000. The survey suggests that, at the target price of £200 per pair of Trackers, there would be a 60 per cent chance of selling 10,000 pairs and a 40 per cent chance of selling 12,000 pairs during 20X1. If the 20X1 volume of sales were to be at the lower level, 20X2 sales would be either 8,000 pairs of Trackers (30 per cent chance) or 10,000 pairs (70 per cent chance). If the 20X1 volume of sales were to be at the higher level, 20X2 sales would be estimated at 12,000 pairs of Trackers (50 per cent chance) or 15,000 pairs (50 per cent chance). In 20X3 the volume of sales would be expected to be 50 per cent of whatever level of sales actually occur in 20X2.

Sales of Trackers would be expected to have an adverse effect on sales of Repros, a less sophisticated loudspeaker, also produced by the business, to the extent that for each two pairs of Trackers sold, one fewer pairs of Repros would be sold. This effect would be expected to continue throughout the three years.

Materials and components would be bought in at a cost of £70 per pair of Trackers.

Manufacture of each pair of Trackers would require three hours of labour. This labour would come from staff released by the lost Repro production. To the extent that this would provide insufficient hours, staff would work overtime, paid at a premium of 50 per cent over the basic pay of £6 an hour.

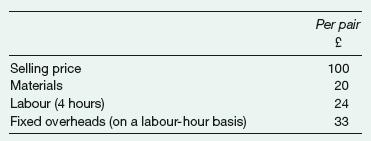

The Repro has the following cost structure:

The management team currently employed would be able to manage the Tracker project, except that, should the project go ahead, four managers, who had accepted voluntary redundancy from the company, would be asked to stay on until the end of 20X3. These managers were due to leave the business on 31 December 20X0 and to receive lump sums of £30,000 each at that time. They were also due to receive an annual fee of £8,000 each for consultancy work which the business would require of them from time to time. If they were to agree to stay on, they would receive an annual salary of £20,000 each, to include the consultancy fee. They would also receive lump sums of £35,000 each on 31 December 20X3. It is envisaged that the managers would be able to fit any consultancy requirements around their work managing the Tracker project. These payments would all be borne by the business and would qualify for full tax relief.

Tracker production and sales would not be expected to give rise to any additional operating costs beyond those mentioned above.

Working capital to support both Tracker and Repro production and sales would be expected to run at a rate of 15 per cent of the sales value. The working capital would need to be in place by the beginning of each year concerned. There would be no tax effects of changes in the level of working capital.

Sales should be assumed to occur on the last day of the relevant calendar year. The corporation tax rate is expected to be 33 per cent throughout the planning period.

On the basis of expected NPV, should Hi Fido plc go ahead with the Tracker project?

Step by Step Answer: