A small mortgage lender has one receptionist, four loan officers, and two office managers. When applicants apply

Question:

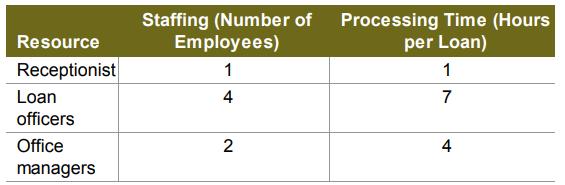

A small mortgage lender has one receptionist, four loan officers, and two office managers. When applicants apply for a new loan in person, they first fill out paperwork with the receptionist. Then the applicants meet with one of the loan officers to discuss their needs. The loan officer spends additional time processing the application after the applicants leave the office. Finally, the application must be reviewed by an office manager before it can be approved. The following table lists the processing times at each stage. The office is open for 8 hours per day, 5 days per week.

a. What is the bottleneck of the process?

b. Assuming unlimited demand, what is the process flow rate (in loans per week)?

c. If customer demand is 18 loans per week, what is the utilization of the office managers resource?

d. If customer demand is 18 loans per week, what is the cycle time (hours) of the process?

e. If customer demand is 24 loans per week, what is the utilization of the loan officers?

f. If customer demand is 24 loans per week, what is the cycle time (hours) of the process?

g. Assuming that the office currently has no backlog of loans that it is processing, how long will it take to complete 10 loans?

Step by Step Answer:

Operations Management

ISBN: 9781260547610

2nd International Edition

Authors: Gerard Cachon, Christian Terwiesch