A pension fund that starts with an initial capital of $250,000 has financial obligations over the next

Question:

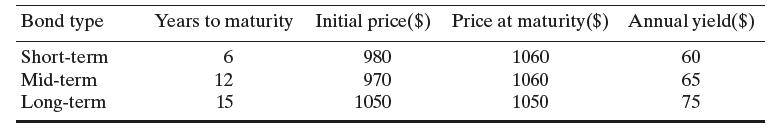

A pension fund that starts with an initial capital of $250,000 has financial obligations over the next 15 years estimated at $11,000 for year 1 and growing at 8.5% per year thereafter. The fund will invest in short-, mid-, and long-term bonds per the financial data in the following table:

All bonds are bought at the start of year 1 and will not earn interest until the start of year 2. The objective is to determine the number of bonds the fund should by to maximize the net cash available at the end of year 15. For the fund to meet its annual payments in any year, the cumulative payments up to that year must not exceed the cumulative available cash up to the same year. Formulate the problem as an expected-value LP and determine the optimum solution.

Step by Step Answer: