Eric Sherm began working as a part-time waiter on April 2, 2018, at Yardville Restaurant. The cash

Question:

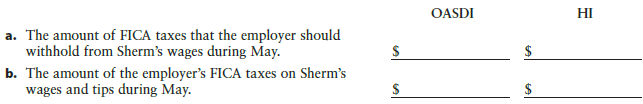

Eric Sherm began working as a part-time waiter on April 2, 2018, at Yardville Restaurant. The cash tips of $475 that he received during April were reported on Form 4070, which he submitted to his employer on May 1. During May, he was paid wages of $630 by the restaurant. Compute OASDI and HI:

Transcribed Image Text:

OASDI HI a. The amount of FICA taxes that the employer should withhold from Sherm's wages during May. b. The amount of the employer's FICA taxes on Sherm's wages and tips during May. %24

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

a The amount of FICA taxes that the employe...View the full answer

Answered By

Robert Mwendwa Nzinga

I am a professional accountant with diverse skills in different fields. I am a great academic writer and article writer. I also possess skills in website development and app development. I have over the years amassed skills in project writing, business planning, human resource administration and tutoring in all business related courses.

4.90+

187+ Reviews

378+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from...

-

Yelman Company is a monthly depositor whose tax liability for June 2018 is $3,930. 1. What is the due date for the deposit of these taxes? 2. Assume that no deposit was made until August 3. Compute...

-

In April of the current year, Steelman Press Company transferred Ken Sherm from its factory in Louisiana to its plant in Florida. The companys SUTA tax rates based on its experience ratings are 3.2%...

-

Specific identification: (a) must be used under IFRS if the inventory items are not interchangeable. (b) cannot be used under IFRS. (c) cannot be used under GAAP. (d) must be used under IFRS if it...

-

Let p, q, r denote the following statements about a particular triangle ABC. p: Triangle ABC is isosceles. q: Triangle ABC is equilateral. r: Triangle ABC is equiangular. Translate each of the...

-

The snowmobile is traveling at 10 m/s when it leaves the embankment at A. Determine the time of flight from A to B and the range R of the trajectory. A 40 3 -R- 5 4 B

-

Petitioner Salman was indicted for federal securities-fraud crimes for trading on inside information he received from a friend and relative-by-marriage, Michael Kara, who, in turn, had received the...

-

Auditing standards require the auditor to obtain an understanding of the entity and its environment as a basis for assessing the risks of material misstatements. Business models differ across...

-

You need your client to send you a copy of a paper receipt so that you can match it to a gas expense in their QuickBooks Online. You create a client request and add a screenshot of the expense entry...

-

What immediate and long-term issues can managers face in organizations that embrace this new drone technology?

-

During 2018, Matti Conner, president of Maggert Company, was paid a semimonthly salary of $5,800. Compute the amount of FICA taxes that should be withheld from her: OASDI HI a. 9th paycheck b. 22nd...

-

Amanda Autry and Carley Wilson are partners in A & W Gift Shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given,...

-

Rodriquez is one of your tax clients and has come to you seeking your input about a potential investment opportunity. Your client has the opportunity to acquire a 30% interest in the capital of a...

-

Gaterburg Hospitals general ledger contains the following unadjusted account balances, among others, for December 31, 20X5: Acct. No. 104 Accounts receivable $120,000 105 Allowance for uncollectible...

-

An American exporter denominates its Australian exports in AUD and expects to receive AUD 2,000,000 in 1 year. The company's financial manager expects the AUD rate after 1 year to be 1.40. The Firm...

-

Select one of your favorite retailers. Research the following topics in detail with thoroughness and completion, and include into a typed minimum 4 page report. In addition, you will need to include...

-

You are given the following information: EUR deposit rate for 1 year 2% EUR borrowing rate for 1 year Australian Dollar deposit rate for 1-year Australian Dollar borrowing rate for 1 year AUD/EUR...

-

On January 1, 2025, Wildhorse Corporation had the following stockholders' equity accounts. Common Stock ($10 par value, 50,000 shares issued and outstanding) $500,000 Paid-in Capital in Excess of...

-

A farmer grows wheat, which she sells to a miller for $100. The miller turns the wheat into flour, which she sells to a baker for $150. The baker turns the wheat into bread, which she sells to...

-

Experiment: Tossing four coins Event: Getting three heads Identify the sample space of the probability experiment and determine the number of outcomes in the event. Draw a tree diagram when...

-

What types of unfair employment practices are prohibited by the Civil Rights Act of 1964 as amended?

-

What is the purpose of the Age Discrimination in Employment Act (ADEA)?

-

Are there any exceptions to the protection afforded older workers by the Age Discrimination in Employment Act?

-

1) describe the key objective of occupational health and safety legislation? 2) We Build It Inc. makes furniture and has a Workplace Safety and Health Program. A Workplace Safety and Health officer...

-

Write a 1400 word essay (MLA format) on the topic following: How Canadian Labour law have changed through history? Include the following. 1. What is Labour law? How much has it changed and developed?...

-

1) Samantha works as a waitress at a restaurant. On Friday night, Samantha was walking through the kitchen area and slipped and fell in a puddle of water that was on the floor. Samantha hurt her back...

Study smarter with the SolutionInn App